Forex indicators without lag and redrawing

Forex traders consistently seek indicators that provide accurate signals without delays or repainting. The absence of lagging and repainting plays a crucial role in successful trading on the Forex market for several reasons.

Indicators that lack lag offer highly precise signals, enabling traders to respond quickly and make timely decisions about when to enter or exit trades. This immediacy is vital in the fast-paced world of Forex where every second counts.

The absence of repainting ensures that the indicator’s values on historical candles remain unchanged, allowing traders to analyze historical data with greater accuracy and reliability. This stability in values helps build confidence in trading decisions, as traders know they can trust the historical performance of their chosen indicators.

Such an approach can alleviate the stress and doubts that often accompany changing indicator values, leading to more confident and informed decision-making.

One reliable tool in this category is the Ichimoku Kinko Hyo, which provides a comprehensive view of the market’s current state, including trend direction and levels of support and resistance. This indicator offers both no lag and no repaint, making it a dependable resource for traders looking to understand market dynamics.

Bollinger Bands also fall into the category of effective indicators, characterized by dynamic levels of support and resistance based on the price’s standard deviation from its moving average. Their consistent performance without lag or repainting makes Bollinger Bands an effective tool for assessing market volatility.

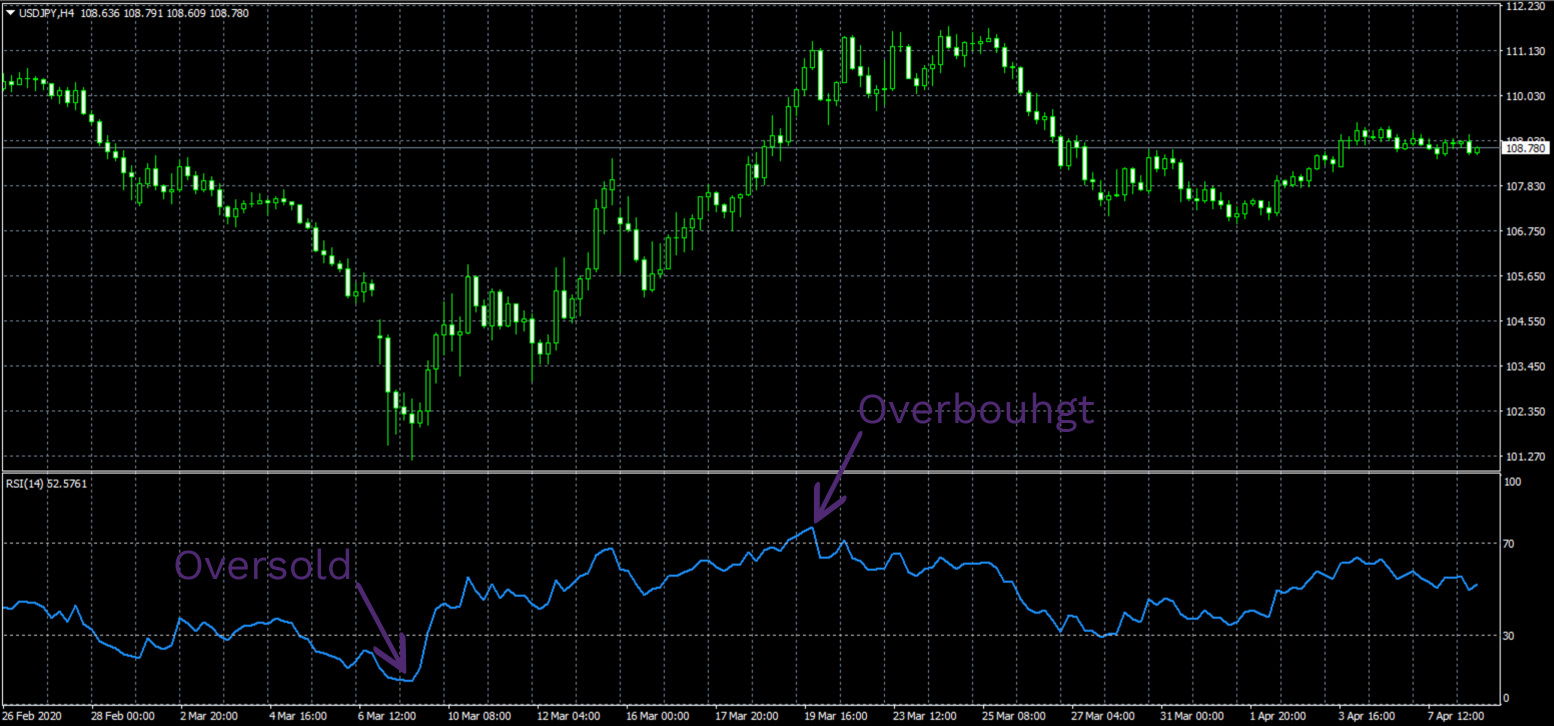

The Relative Strength Index (RSI) is another essential indicator, designed to identify overbought or oversold conditions in the market. The RSI provides reliable signals without lagging or repainting, making it suitable for pinpointing reversal moments and entry points for trades.

Divergence of Moving Averages, particularly the Moving Average Convergence Divergence (MACD), illustrates the difference between two moving averages, assisting traders in determining the current trend direction. This indicator is also free from lag and repainting, making it effective for detecting trend shifts and entry points.

SuperTrend is a straightforward indicator that indicates the current trend direction and helps traders identify optimal entry and exit points. Like the previous indicators, SuperTrend operates without lag or repaint, establishing its value as a trading tool in the Forex market.

In summary, Forex indicators without lagging and repainting are reliable tools for traders pursuing accurate trading decisions and successful practices in the currency market. Employing these indicators helps ensure precise signals that support traders in making well-founded decisions regarding entry and exit points. By integrating such indicators into their strategies, traders can enhance their analysis and improve their chances of achieving consistent profitability in the dynamic Forex trading environment.