What is stop out

Stop Out is a crucial margin level in the Forex market. When this level is reached, it leads to the forced closure of one or more of a trader’s positions to prevent a negative balance in their trading account. This mechanism is designed to protect both the trader and the broker from substantial losses.

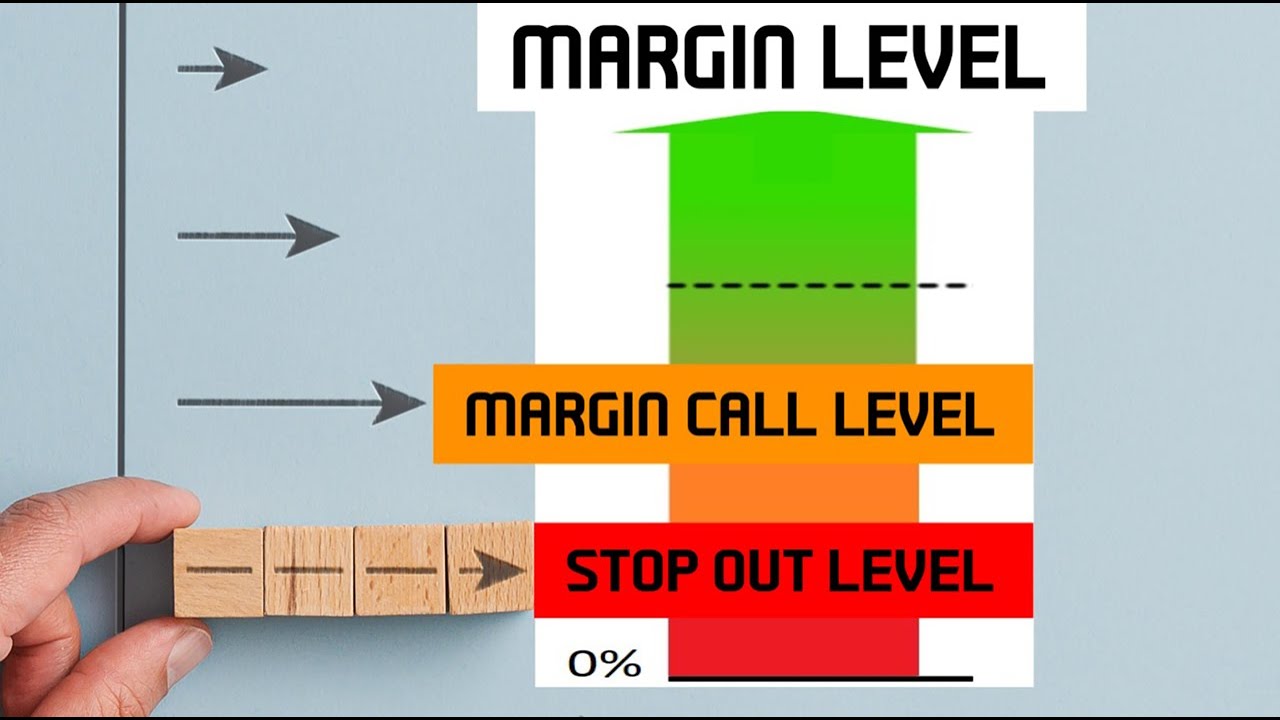

When traders open positions in the Forex market, they typically use borrowed funds, or leverage, provided by their broker. The margin amounts to the funds required to maintain these open positions. The margin level is expressed as a percentage and is calculated by taking the trader’s equity and comparing it to the required margin.

A Stop Out occurs when the margin level in a trader’s account falls to a specified threshold set by the broker. Once this threshold is breached, the broker will automatically close one or more of the trader’s positions, which could lead to unexpected losses.

To minimize risks, diversifying a portfolio and employing hedging strategies are essential. Traders should avoid opening too many positions in the same direction or on correlated instruments, as this can make a portfolio vulnerable to adverse market movements. Implementing hedging strategies can safeguard against unfavorable market fluctuations.

The Stop Out mechanism is vital for preventing traders’ accounts from going into negative balance, making it an important component of risk management. To avoid reaching this critical margin level, traders need to manage their positions and risks effectively. This includes setting stop-loss orders, utilizing lower leverage, and consistently monitoring their margin levels.

Understanding how the Stop Out mechanism works, along with taking proactive steps to avoid it, can greatly improve trading outcomes and help avert unforeseen losses. Proficient risk management and the effective use of leverage are key factors for successful trading in the Forex market.

In summary, Stop Out serves as an essential risk management feature in Forex trading, protecting both traders and brokers from significant financial losses. Being aware of how Stop Out functions and maintaining effective strategies to manage positions can enhance a trader’s performance and resilience in this volatile environment. By prioritizing risk management and leveraging tools wisely, traders can navigate the complexities of Forex more successfully and work towards achieving their trading goals.