What are pending orders in Forex?

Pending orders in the Forex market are essential tools that enable traders to automate their trading and manage risks effectively. Understanding how these orders function allows for more strategic planning and better utilization of market opportunities.

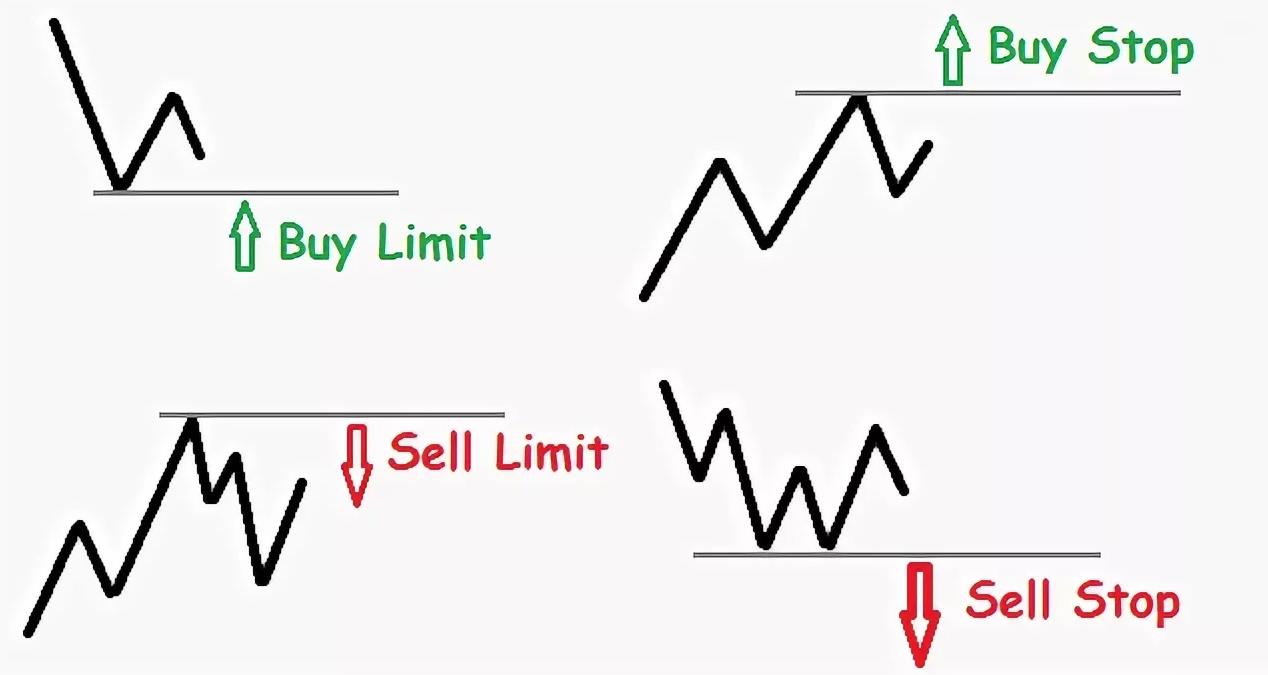

Pending orders are instructions to buy or sell a currency pair that are executed automatically when the price reaches a preset level. Unlike market orders, which are executed at the current market price, pending orders allow traders to specify the conditions under which they wish to enter or exit a trade.

By automating the process of opening and closing trades, pending orders help reduce the likelihood of missed opportunities and improve overall efficiency. Traders can set levels for entry and exit in advance, enhancing their risk management capabilities. For instance, a trader might establish a stop-loss and take-profit level alongside a pending order, which would automatically close the position once it reaches either a certain loss or a predefined profit.

Trading can be emotionally taxing, especially when making decisions during periods of high volatility. Utilizing pending orders can alleviate some of this emotional stress, as it allows traders to plan their actions in advance and avoid impulsive decisions driven by market fluctuations.

Additionally, pending orders can be employed in conjunction with technical analysis to facilitate trade entries and exits. One common strategy is the grid trading approach, which involves placing multiple pending orders to buy or sell at various price levels. This method enables traders to capitalize on price swings within a narrow range effectively.

Pending orders can also be utilized to diversify a trading portfolio by opening positions across different currency pairs at various levels. This strategy helps mitigate overall risk while increasing the potential for returns.

In essence, pending orders are flexible and powerful tools that offer numerous opportunities for automating trading, managing risks, and maximizing profits in the Forex market. Understanding and leveraging these tools can significantly enhance a trader’s performance and improve decision-making processes.

In conclusion, using pending orders allows traders to navigate the Forex market with greater precision and confidence. By implementing these strategies and maintaining sound risk management practices, traders can better position themselves for success and ultimately achieve their financial objectives. These orders form a vital component of a trader’s toolkit, enabling them to execute well-thought-out strategies and respond to market movements with agility and foresight.