Liquidity risks in Forex

Trading in the Forex market comes with various risks, one of which is liquidity risk. This risk is crucial for ensuring the stable and efficient execution of trades.

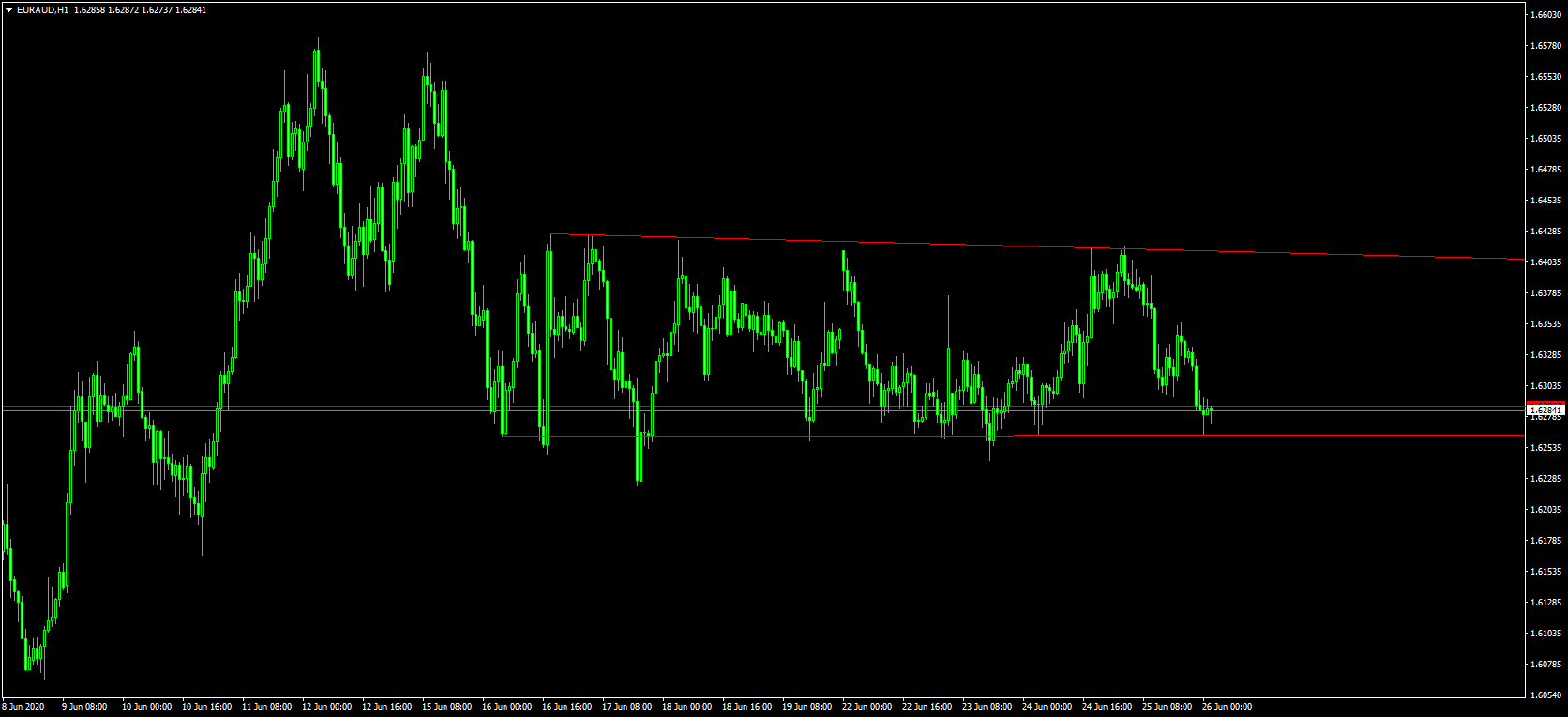

Liquidity risk is associated with the possibility of being unable to buy or sell a currency at the desired price due to insufficient market volume. This concept is defined by the market’s ability to absorb large orders without significantly impacting the price.

High liquidity is characterized by tight spreads, swift order execution, and minimal impact of large trades on prices. This is typically observed when trading major currency pairs, where the market is well-populated with buyers and sellers.

On the other hand, low liquidity is marked by wider spreads, slower order execution, and significant price changes stemming from large trades. This scenario often occurs with exotic currency pairs or during periods of diminished market activity.

Liquidity levels can fluctuate throughout the day. For instance, during the Asian session, liquidity is often lower compared to the European and American sessions, which can affect trading strategies.

Events like elections, political crises, and international conflicts can trigger substantial price volatility. During these times of low liquidity, the spreads between buying and selling prices may widen considerably, increasing the costs associated with entering and exiting trades.

Low liquidity conditions can result in orders being filled at less favorable prices, known as slippage. Furthermore, brokers themselves face liquidity risk if they are unable to provide the necessary market backing to fulfill their clients’ orders. This situation can arise during periods of extreme market volatility or financial instability within the brokerage.

Liquidity risk is a crucial factor that market participants must take into account when planning their trading strategies. Understanding the causes and effects of low liquidity, along with employing effective risk management techniques, can help reduce negative impacts on trading performance.

Paying careful attention to trading times, staying updated on news developments, and selecting reliable brokers are essential practices to effectively cope with liquidity risks and achieve financial objectives.

In summary, liquidity is an essential element in Forex trading, significantly influencing the execution of trades and overall trading costs. By grasping the dynamics of liquidity risk and implementing informed strategies, traders can navigate the challenges of the Forex market more successfully. Proactive risk management and a solid understanding of market conditions will ultimately enhance trading results and contribute to achieving long-term trading aspirations.