Forex percentage retracement

Percentage retracement, also known as price retracement, is a widely used tool in technical analysis within the Forex market. This method helps identify potential support and resistance levels on price charts, which can be crucial when making decisions about entering or exiting trades.

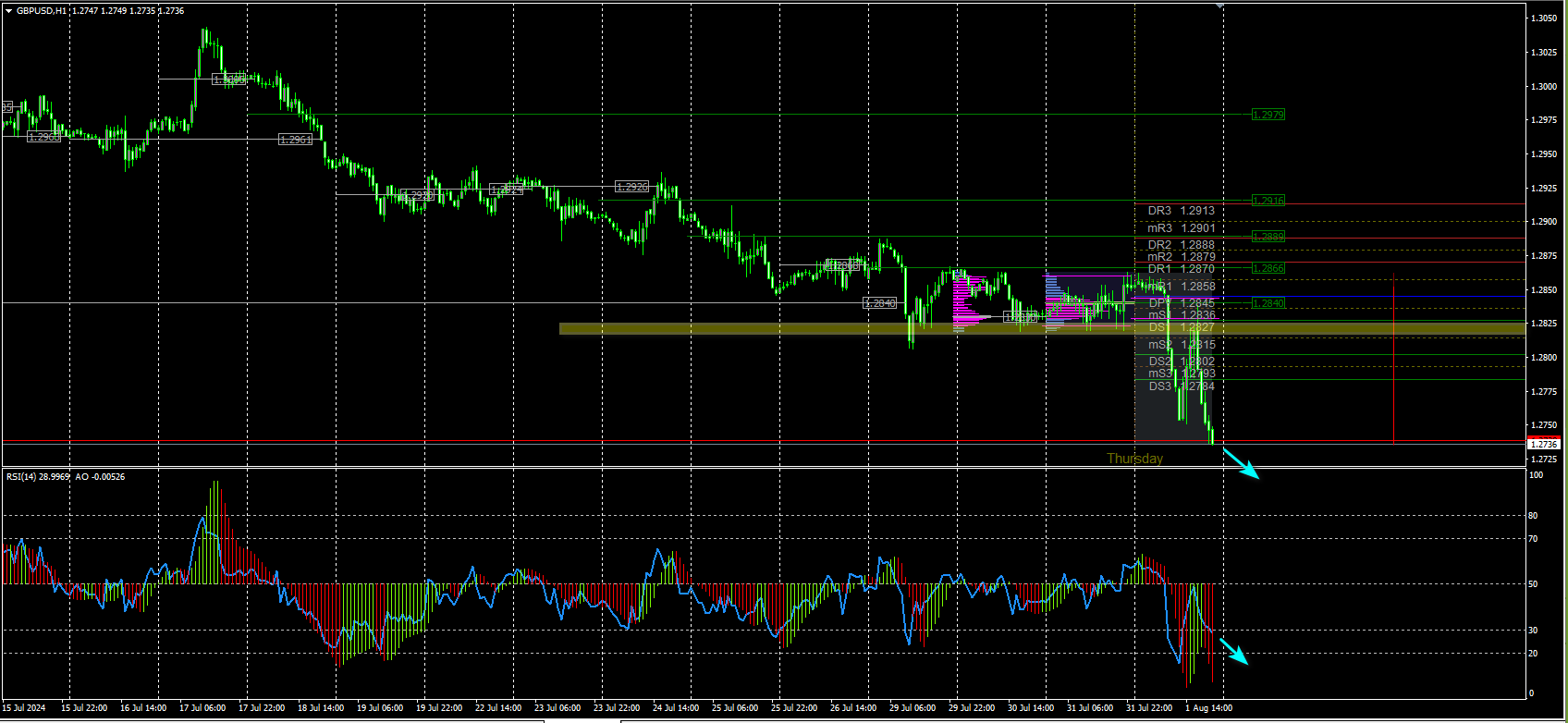

The approach involves determining possible price correction levels after a significant movement upward or downward. It is based on the premise that prices often retrace a certain percentage of their initial movement before resuming their prevailing direction.

The concept relies on the idea that prices tend to correct to specific percentage levels after substantial price movements. These levels are determined as a percentage of the previous price movement. For example, if a currency pair has experienced a considerable upward movement, it may pull back by a specific percentage of that movement before continuing to rise again.

To enhance the effectiveness of percentage retracement, many market participants combine this method with other technical analysis tools. By doing so, they can obtain more accurate signals and reduce the risk of false entries.

Moving averages, for instance, assist in identifying trend direction and strength. When retracement levels align with support or resistance areas identified by moving averages, it adds significance to the trading signal and can serve as a confirmation for entering a trade.

This method can also be effectively paired with trend lines and price channels. If prices retrace to a level that coincides with a trend line, it may indicate a strong zone of support or resistance, further validating the trading opportunity.

One of the common pitfalls is when market participants disregard the overall trend and attempt to trade against it based solely on retracement levels. To avoid this mistake, it is essential to use percentage retracement in the context of the prevailing trend, making trades that align with it rather than against it.

Traders may mistakenly treat retracement levels as the only critical points and enter trades without additional confirmation. It is crucial to employ other analytical tools to validate these levels and signals.

At very short time frames—such as minute charts—percentage retracement can generate an excessive number of false signals. It is often more effective on larger time frames, such as hourly or daily charts, where the signals tend to be more reliable.

This powerful technical analysis tool can significantly assist traders in the Forex market. It helps identify potential price correction levels and can be used to pinpoint entry and exit opportunities. However, it is important to remember that the method works best in conjunction with other tools and approaches. Proper implementation of this technique can greatly increase the chances of successful trading, but traders should always consider other influencing factors, such as news, macroeconomic data, and overall market trends.