Trading Bot on Binance

One example of streamlined trading is the use of trading bots, which help traders optimize their transactions. This article will explore what a trading bot on Binance is, how it works, its advantages, and potential risks.

A trading bot is software that automatically executes transactions on the Binance cryptocurrency exchange according to predefined algorithms. It analyzes the market, evaluates current trends, and decides when to buy or sell assets without human intervention. These bots can operate across various platforms, including arbitrage, scalping, indicator-based trading, and AI-driven trading strategies.

Binance is one of the largest and most popular cryptocurrency platforms in the world. Its popularity is due to several key advantages:

The exchange offers high trading volumes, allowing traders to find counterparties quickly without significant price slippage.

There is a wide variety of trading instruments available, including numerous cryptocurrency pairs and various types of orders that enable traders to implement diverse strategies.

Binance features some of the lowest trading fees in the market, especially when using BNB tokens to pay for fees.

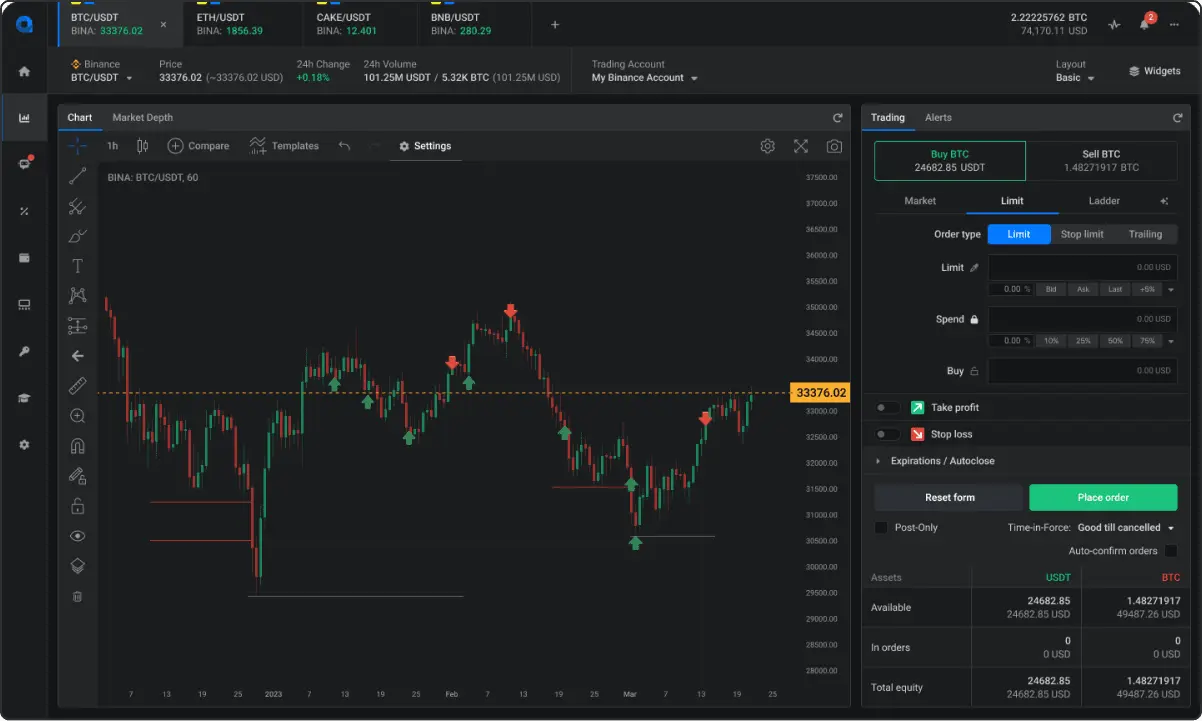

The advanced trading platform provides professional charts, indicators, and analysis tools that make trading efficient and user-friendly.

The exchange employs modern security technologies, including two-factor authentication (2FA), cold storage for assets, and anti-phishing measures.

Binance offers an API that allows for the integration of trading bots and the automation of trading processes. It supports multiple languages, features an intuitive interface, and is accessible to users from different countries.

Despite all these advantages, trading with bots comes with risks and limitations that can significantly affect trading efficiency.

Market Changes – Even the most advanced algorithms cannot predict all market fluctuations. Bots analyze historical data and current trends, but sudden events, such as regulatory changes or global crises, can lead to substantial losses.

Technical Failures – The software that supports trading bots must address any technical issues. Errors in coding, dependencies, internet connection problems, or exchange-side outages can result in improper order execution. This may lead to serious financial losses.

Need for Configuration and Monitoring – For a bot to work effectively, it requires regular updates and fine-tuning of its algorithms. Without appropriate oversight, the bot may operate inefficiently, miss profitable trades, or, conversely, execute losing contracts. Beginners lacking the knowledge for trading methods and programming may find it challenging to properly configure and manage the bot.

Fraudulent Schemes – The trading bot market is not immune to scams, which creates additional regulatory burdens for users. Developers may offer bots that promise high income, but some alternatives can prove ineffective or even deceptive. Such programs could result in financial loss or allow fraudsters to gain access to user accounts.

Ethical and Legal Aspects – Automated trading is increasingly scrutinized by regulators. In some countries, using certain algorithms may be banned or restricted. Before using a bot for trading, it’s essential to study the local legislation to avoid legal consequences.

Traders looking to implement automated trading should thoroughly understand how bots work and the associated risks. Only then can managed trading become a reliable ally in the global cryptocurrency market.