Advantages and disadvantages of scalping

Scalping is a short-term trading method in financial markets where traders aim to profit from small price movements. Trades are executed within minutes or even seconds, requiring constant attention and quick reactions to changes in market quotes. This approach appeals to both newcomers and seasoned market participants as it allows for rapid results, although it does come with its own set of risks.

The primary advantage of scalping is the potential for quick profits. Traders can execute dozens or even hundreds of trades in a single trading day, striving to capitalize on minor price fluctuations. A successful trader can finish the day with a positive balance without waiting for long-term market changes.

This method involves executing a large number of trades in a short period, allowing traders to practice and rapidly accumulate market experience. They can promptly test strategies and instantly adjust their actions based on results.

Since trades are held for just a few minutes, scalpers minimize exposure to long-term factors such as economic reports, news, or geopolitical events. This enables them to avoid the market during sudden price spikes.

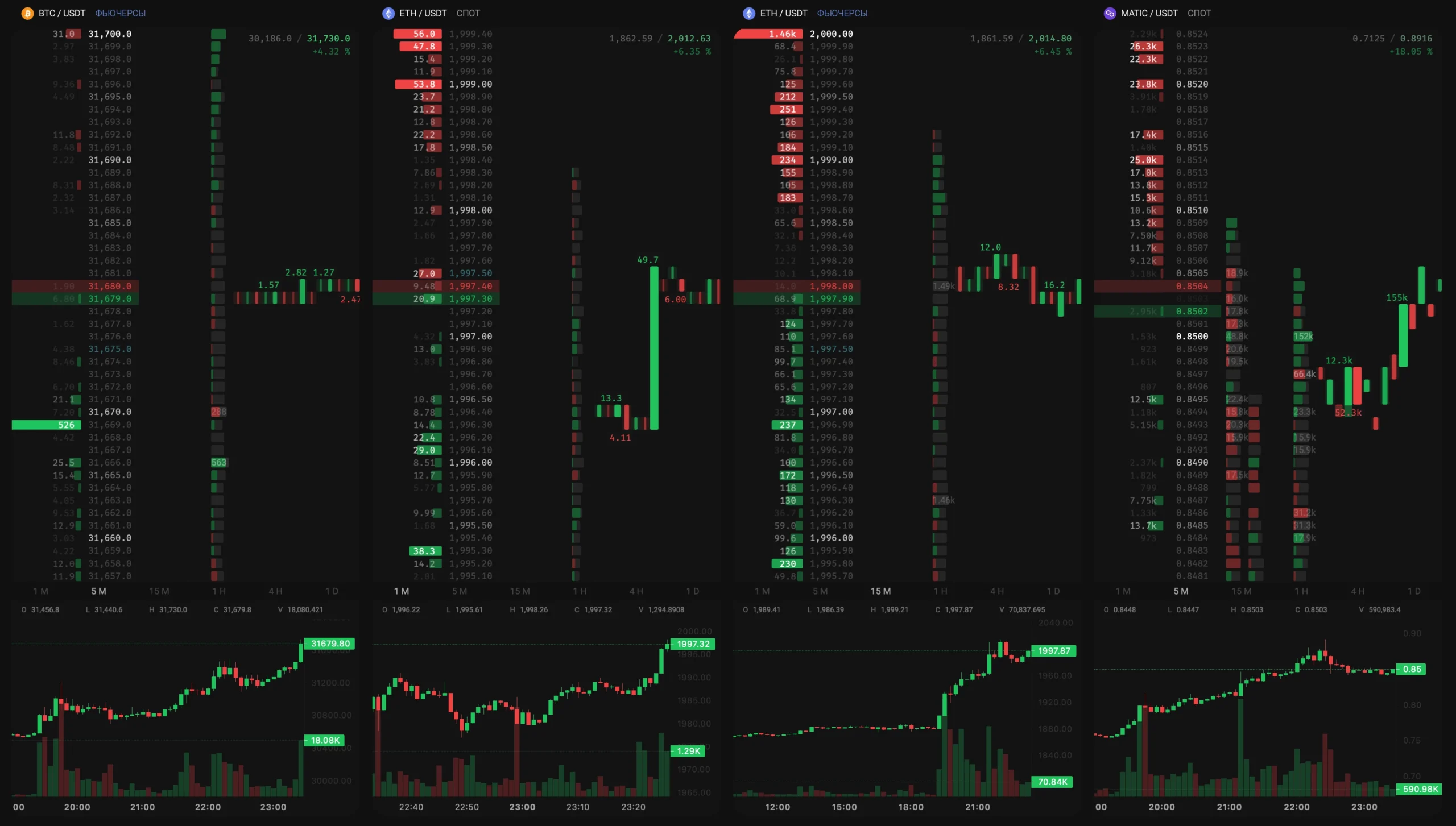

Scalping strategies can be applied across various markets—stocks, currency pairs, futures, and cryptocurrencies. This allows traders to select the most volatile assets at any given moment, increasing their chances of making successful trades.

The method relies on technical analysis and the use of indicators, allowing traders to navigate without delving deep into macroeconomic factors or news. This simplifies operations and speeds up decision-making processes.

However, despite the short duration of trades, scalpers face a high level of risk. A minor error in forecasting or a sharp price jump can lead to losses that accumulate quickly due to the volume of trades; a single bad session can wipe out previous gains.

As market participants conduct numerous trades, each is accompanied by broker fees and costs on the spread (the difference between the buying and selling price). In unsuccessful trades or with insufficient profit levels, these costs can consume a significant portion of the income.

Scalping requires constant market monitoring and rapid decision-making. This leads to heightened emotional stress, especially if the market behaves unpredictably. A trader must be prepared for ongoing stress and maintain focus throughout the trading day.

This strategy may not always be applicable in less volatile markets, where price changes occur slowly. It’s also essential to consider liquidity: not all assets are suitable due to excessively large spreads or low trading frequency.

Successful scalpers are traders with a strong technical understanding of the market, the ability to manage emotions, and effective trading discipline. For those looking to try scalping, it’s important to carefully weigh the risks and benefits of this strategy.