Bot for trading indices

What is an index trading bot? It’s an automated system capable of independently making buy or sell decisions regarding stock market indices. Indices, in turn, are collections of stocks that reflect the health of a specific sector or the entire market. Examples include the S&P 500, NASDAQ, Dow Jones, and others. Managing them manually is challenging, as it requires constant monitoring of dozens of factors, including economic reports, corporate news, and geopolitical developments. A bot can handle this much faster than a human.

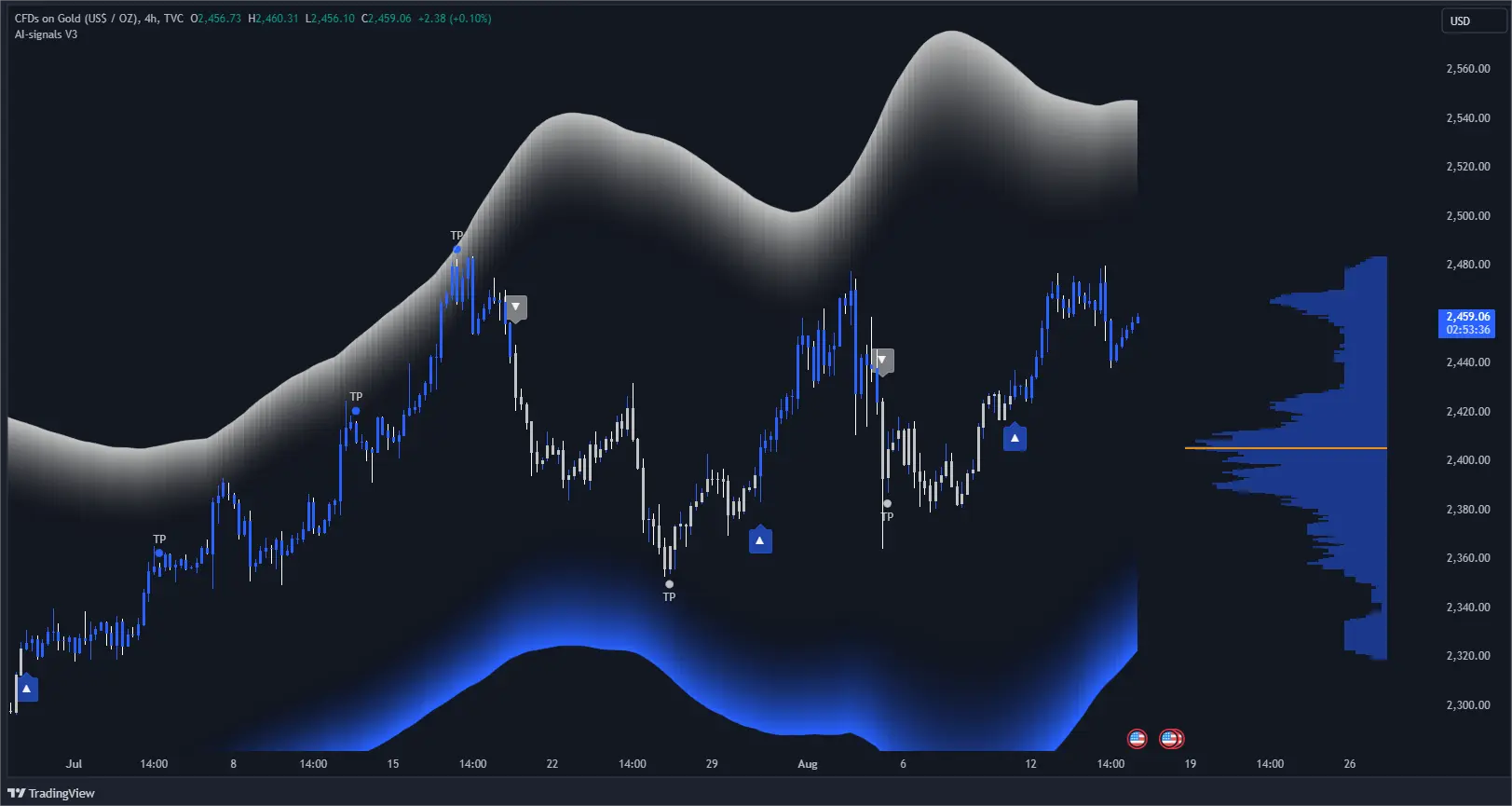

The main goal of a trading bot is to generate profits while minimising risks. It analyses vast amounts of data: charts, trading volumes, historical trends, news, and even signals from other markets. Based on defined algorithms, it then decides whether to enter or exit the market. Importantly, it operates without emotion, which is one of its key advantages. Traders are often prone to panic or greed, leading to unprofitable trades. A bot, however, acts strictly according to logical rules.

Creating an effective trading bot requires deep expertise in programming, mathematics, and finance. Developers need to consider numerous factors: market volatility, order execution speed, reactions to news, and the ability to test strategies on historical data. Languages like Python or C++ are commonly used, integrating with trading platforms via APIs.

However, it’s important to remember the risks. Despite their efficiency, bots do not guarantee consistent profits. Markets can be unpredictable, and even the most complex algorithms may fail. That’s why a skilled trader continually monitors their automated system and intervenes when necessary.

Trading indices allows investors to profit from entire sectors or markets without buying dozens of individual stocks. For example, purchasing an S&P 500 index fund means investing in 500 of the largest US companies, lowering the risk of losses from a decline in any single stock.

Indices are also popular for short-term speculation. Traders can profit from both rising and falling indices by using instruments like futures, options, and CFDs (contracts for difference). This broadens trading opportunities in any market conditions.

Many brokers enable traders to use leverage when trading indices. While this can magnify potential gains, it also increases risks. Such options are particularly attractive for active traders seeking higher returns.

An index trading bot is a powerful tool in the modern trader’s arsenal. It can significantly simplify trading, boost efficiency, and free up time. However, it requires careful setup, thorough understanding, and continuous oversight. When used responsibly, technology can truly enhance trading performance rather than become a source of losses.