Canceling orders on Forex

Trading in the Forex market provides a wide range of instruments and strategies that help traders effectively manage their positions and risks. One particularly helpful tool is the OCO order (One Cancels Other), which consists of two linked orders: a limit order and a stop order.

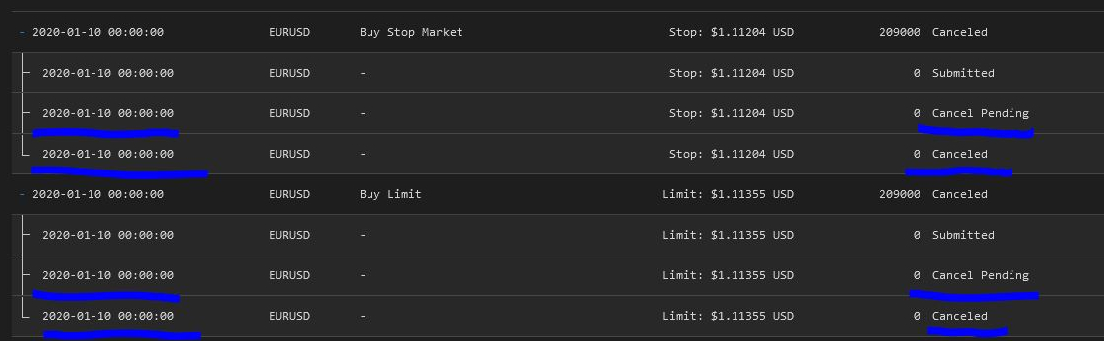

This type of conditional order operates on the principle of mutual exclusivity. When you set up an OCO order, each order is designed to execute at a specified price, but when one order is filled, the other is automatically canceled. This feature allows traders to prepare for two distinct scenarios related to the same position, helping manage risk while optimizing profit potential.

The main advantage of OCO orders is the ability to establish levels at which to secure profits or limit losses, thus providing greater protection for capital. By defining these levels in advance, traders can ensure that their exit strategy is implemented automatically, aligning with their trading plan.

Additionally, OCO orders facilitate the automation of trading processes, reducing the need for constant market monitoring, especially during periods of high volatility. This allows traders to plan their actions based on various market scenarios, thereby increasing the overall efficiency of their trading strategies.

Setting up an OCO order involves several steps:

- Selecting currency pairs: Choose the pairs you wish to trade based on your analysis.

- Establishing entry and exit levels: Specify the prices at which you want to buy or sell.

- Configuring stop-loss levels: Determine the point at which you want to limit potential losses.

- Setting the OCO order parameters: Input all necessary details for both the limit and stop orders.

- Reviewing and confirming order details: Double-check your entries and finalize the setup of the orders.

OCO orders are powerful tools in Forex trading, enabling traders to manage risks effectively while optimizing their trading strategies. The ability to implement two alternative orders provides a safeguard for positions and locks in profits as they reach target levels.

In conclusion, mastering OCO orders can enhance your trading experience by allowing you to automate decision-making and mitigate risks. With OCO orders in your trading toolkit, you can navigate the complexities of the Forex market with greater confidence and efficiency. By integrating OCO orders with sound analysis and robust risk management practices, traders can set themselves up for long-term success in the ever-evolving financial landscape.