Forex strategy development

Creating an effective trading strategy in the Forex market is a critical step toward achieving success in currency trading. A well-defined strategy outlines the rules for entering and exiting trades, managing risks, and determining trading timeframes.

The first step in crafting a Forex strategy is to clarify your trading goals and preferred trading style. Decide whether you plan to engage in longer-term trades or focus on short-term opportunities, and consider how comfortable you are with taking risks.

Before developing your strategy, it’s essential to conduct thorough market analysis. Examine the key factors that influence currency prices, such as economic indicators, geopolitical events, and shifts in global financial markets. Based on your analysis, you can establish specific conditions for entering and exiting trades.

Traders can also devise their strategies based on chart analysis and price movements. Some may opt for short-term tactics that rely on quick reactions to minor price fluctuations, while others may choose long-term strategies that focus on overarching market trends. Each trader can select a trading style that best aligns with their objectives and risk tolerance.

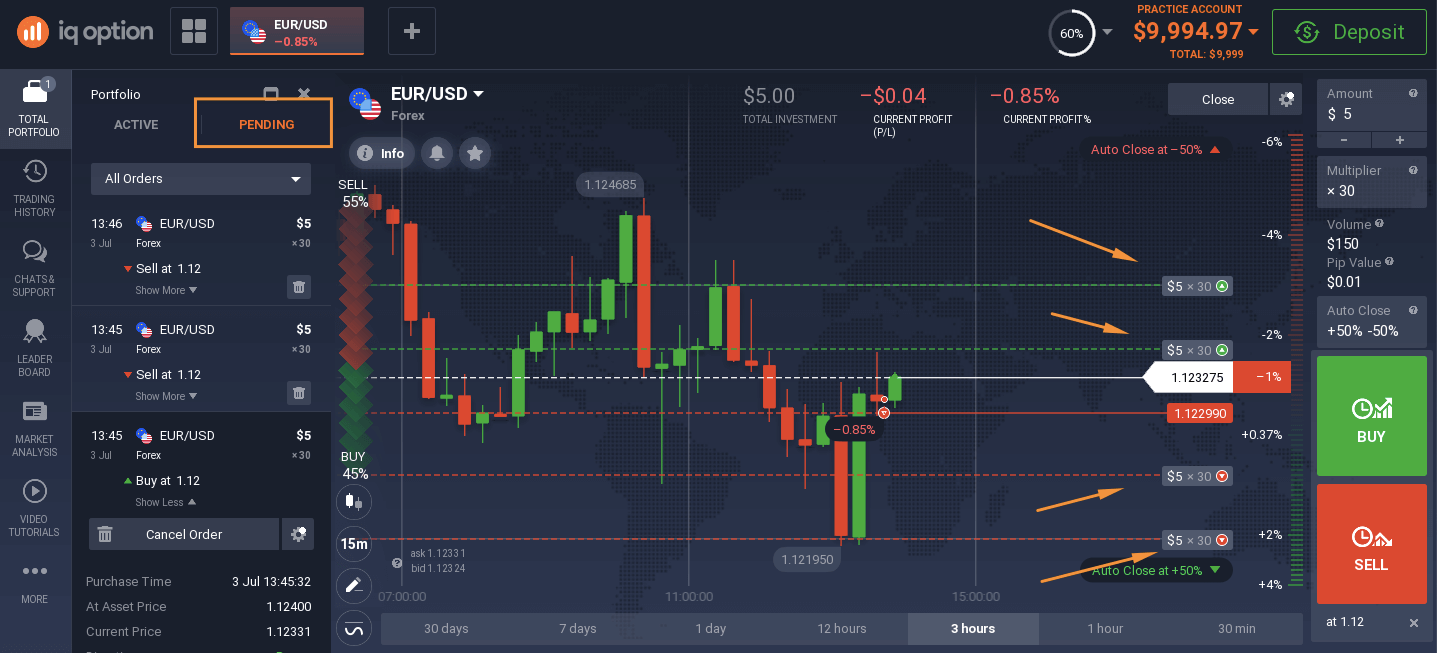

Given that the Forex market is inherently high-risk, effective risk management plays a vital role in a trader’s success. Accurately determining position sizes, setting stop-loss orders, and diversifying capital among various trades can help minimize losses in the event of unfavorable market movements.

Additionally, sticking to your strategy is crucial. Emotion-driven decisions can undermine the best-laid plans, so maintaining discipline and following your predefined rules can be the difference between success and failure in trading.

Finally, as you implement your strategy, it’s important to remain adaptable. The Forex market is constantly changing, and what works today may not be as effective tomorrow. Regularly reviewing and refining your strategy based on market conditions and your trading performance is essential for long-term success.

In summary, developing a solid Forex trading strategy involves outlining your trading goals, conducting thorough market analysis, and implementing effective risk management techniques. By establishing clear entry and exit rules, choosing a suitable trading style, and remaining disciplined, you can significantly increase your chances of success in the competitive world of currency trading. With dedication and continuous learning, your strategy can evolve alongside the market, leading to potentially profitable outcomes.