Gap in Forex

A gap represents the difference between the closing price of one trading period and the opening price of the next. In the Forex market, gaps often occur after weekends or significant economic events, resulting in a sudden price spike either upwards or downwards. Gaps can present both earning opportunities and additional risks.

Unlike stocks or other financial markets, Forex operates 24/5. However, trading halts over the weekend, and if important economic or political events occur during that time, the opening market price on Monday can differ significantly from the closing price on Friday.

One of the most popular strategies is trading the gap closure, as most gaps tend to close (the price returns to the level before the gap) within a certain timeframe. This approach is based on the assumption that the market seeks to fill the gap and revert to the previous price level.

Although gaps often arise against a backdrop of news, predicting their direction and magnitude can be challenging. Opening a position before the weekend or significant events can lead to unexpected losses.

Never trade without a protective stop-loss, especially if a gap occurs on important news. This will help you avoid substantial losses if the market moves against your position.

Before opening trades, consider the economic events that could impact the market. Gaps often appear after significant news, so it’s important to be prepared for their emergence.

On daily charts, gaps are most prominent and typically occur after the market closes on Friday and reopens on Monday. Such gaps may be triggered by key news or events taking place over the weekend. In most cases, they appear at the beginning of the trading week and may correlate with significant market movements.

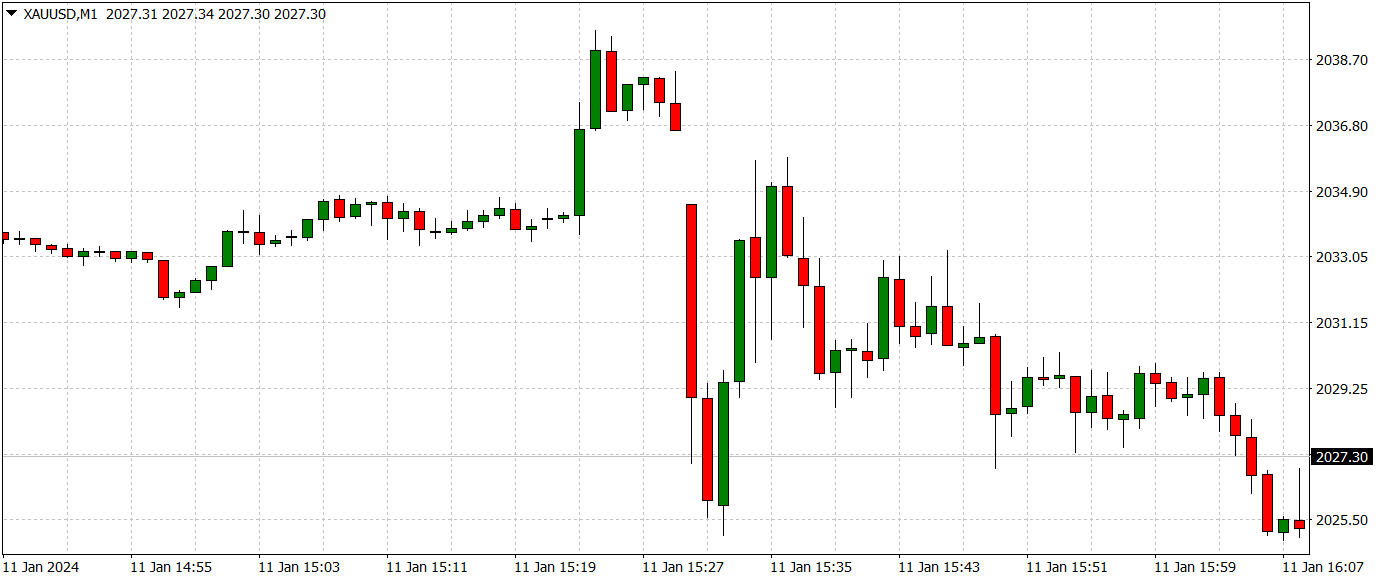

On minute charts, gaps are rare and usually not very significant since such gaps tend to fill quickly on shorter time frames. However, during major news releases or market openings, such gaps can occur.

Gaps in the Forex market are an intriguing phenomenon that traders can effectively capitalize on. Understanding the causes of gaps and knowing various trading strategies allows traders to maximize their profit potential from these price discrepancies. It’s essential to consider the risks associated with trading gaps and apply sound capital management techniques to minimize potential losses.

Gaps can provide both opportunities for quick profits and considerable risks, especially when unprepared for sudden price changes. Regardless of the chosen strategy, success in trading depends on thorough analysis, discipline, and the ability to adapt to market conditions.