How does trading volume affect Forex?

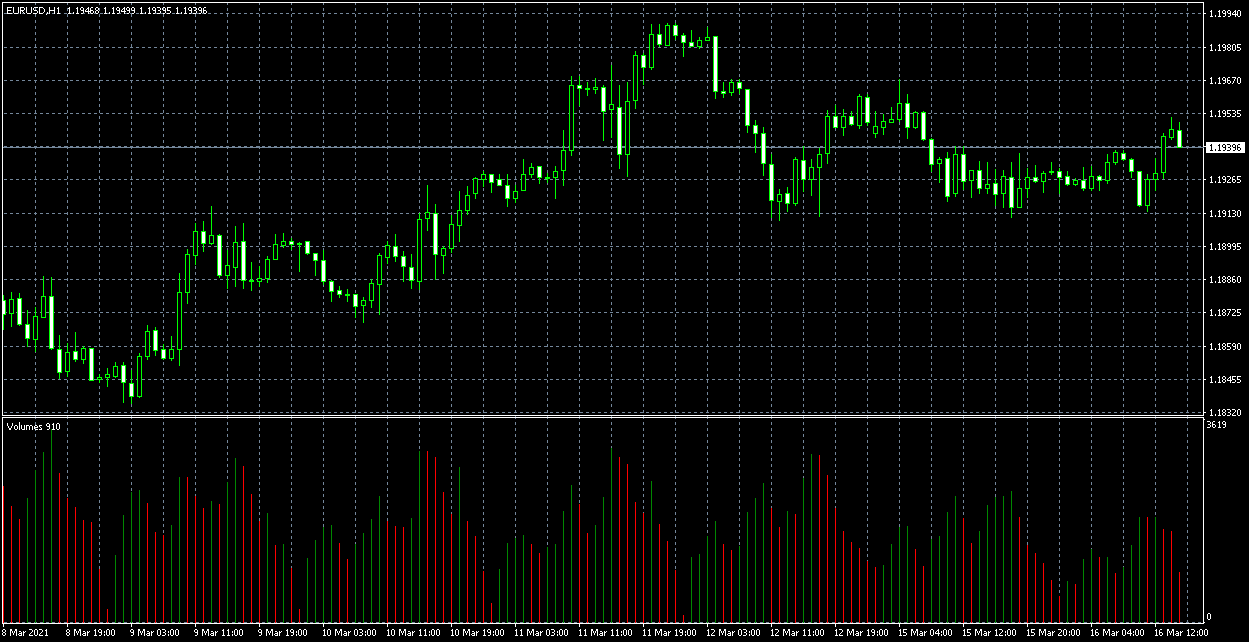

The Forex market, known as the largest and most liquid financial market in the world, is influenced by a multitude of factors that affect the price dynamics of currency pairs. One of the key factors in this environment is trading volume, which plays a crucial role in trend formation, assessing market strength, and identifying potential reversal points.

Trading volume is directly related to market liquidity. A higher trading volume typically means a more liquid market, which reduces the chances of slippage when orders are executed. However, while elevated trading volumes can enhance liquidity, they can also lead to increased volatility, presenting both risks and opportunities for traders aiming to capitalize on price movements.

Volume serves as a confirmation tool for the strength of ongoing trends. When the volume rises alongside a trend, it serves as a strong signal for its continuation, indicating a favorable opportunity for traders to enter positions. Conversely, when the trend is accompanied by declining volume, it can indicate a potential weakening, suggesting traders should be cautious.

Low trading volume during periods of extreme volatility or when prices are near key highs or lows can signal potential overbought or oversold conditions. In these instances, a shift in price direction is more likely, making volume an essential metric for anticipating reversals.

Market events and news releases significantly impact trading volume. These events can lead to temporary fluctuations in liquidity and volatility, presenting traders with both risks and opportunities for profit. For example, an unexpected economic announcement can spur trading activity, quickly altering the market landscape.

In various trading strategies, volume analysis is often employed as a supplemental indicator to reinforce signals from other technical indicators, such as moving averages. An increase in volume when a signal forms can bolster a trader’s confidence in the validity of that signal, providing additional assurance before entering a trade.

Overall, trading volume is fundamental to understanding the Forex market. It offers insights into the market’s current state and aids traders in making informed decisions. Beyond technical indicators, volume is influenced by fundamental data and the prevailing market atmosphere.

In conclusion, incorporating trading volume into your market analysis is vital for achieving greater accuracy and enhancing your trading strategies. By acknowledging the relationship between volume, price movements, and market volatility, traders can better position themselves for success in the Forex market. Whether you’re a novice trader or a seasoned veteran, a thorough comprehension of trading volume can significantly influence your ability to interpret market conditions and navigate the complexities of currency trading effectively.