How to identify a downward trend

The Forex market is characterized by constant price fluctuations, and one of the key elements that assists traders in making decisions is the trend. A downward trend refers to a period during which prices consistently decline over time. Understanding and accurately identifying this trend is essential for successful trading.

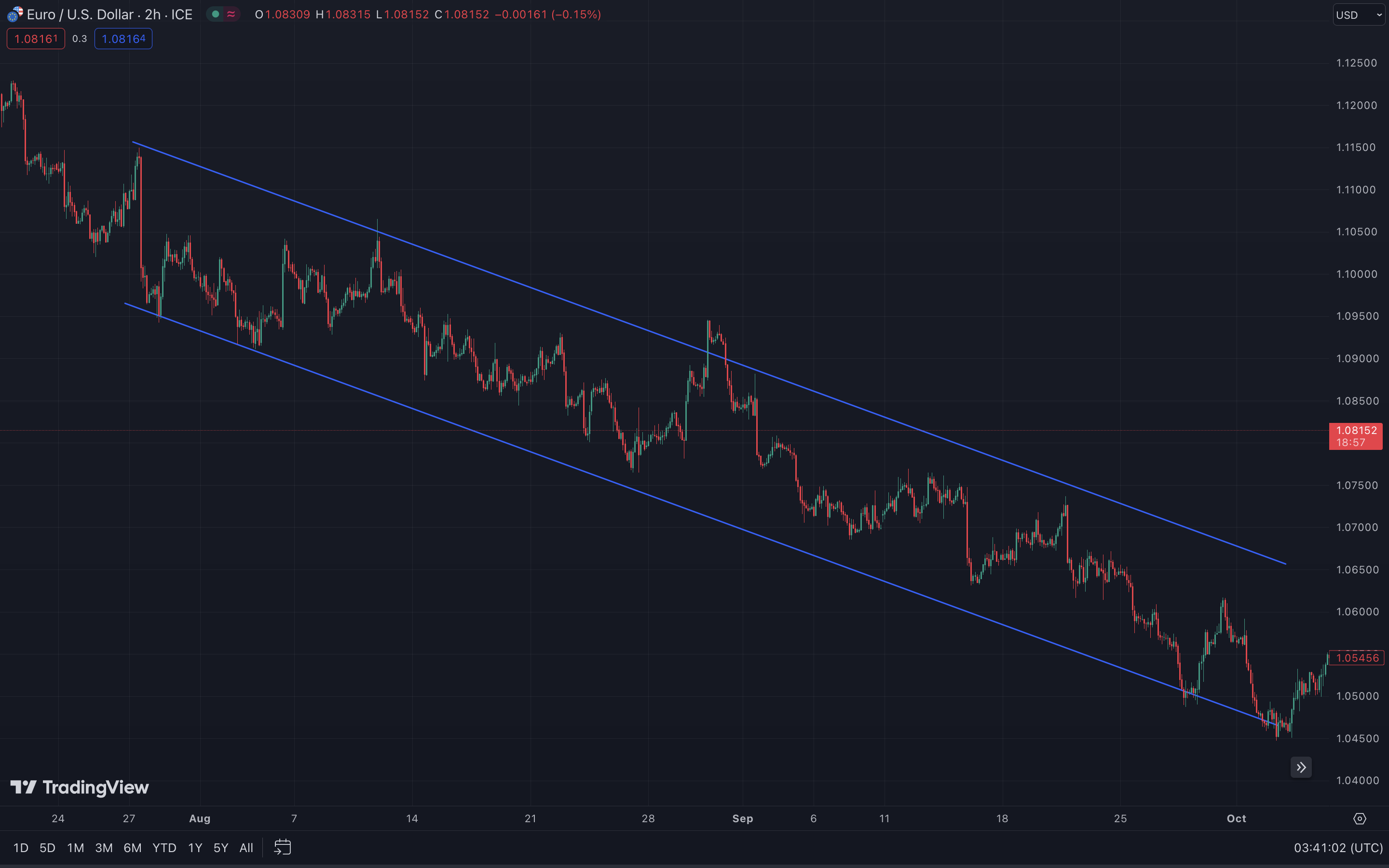

A downward trend is marked by a series of declining price levels, where each successive peak and trough on the price chart falls below the previous ones. This pattern indicates that sellers dominate the market, as evidenced by increased supply and decreasing prices.

Traders often employ moving averages to identify trends. In a downward trend, prices typically remain below the moving average, which will display a negative slope, reflecting the general downward movement in prices.

On the price chart, a downward trend is further confirmed by the presence of lower highs and lower lows. This consistent pattern indicates a sustained decrease in prices over a given timeframe, providing valuable insights into market conditions.

Recognizing a downward trend helps traders discern the overall market direction, enabling them to make informed decisions about entering short positions. Trading in line with the current trend enhances the chances of capitalizing on potential profits.

This trend identification allows for effective risk management, as traders can establish stop-loss and take-profit levels based on support and resistance levels aligned with the downward trend.

In addition to price movements, trading volumes can also confirm a downward trend. An increase in volume alongside falling prices signals a strengthening of the trend and reinforces its validity.

Support and resistance levels on price charts play a crucial role in helping traders identify key points within a downward trend. A break below a support level or a bounce off a resistance level can serve as confirmation of the trend’s strength.

The presence of a downward trend offers traders various opportunities to profit from falling asset prices. Identifying such trends necessitates careful market analysis using a range of methods and tools. Traders skilled in recognizing and capitalizing on downward trends can achieve substantial results.

In conclusion, a downward trend is a significant period for traders, presenting opportunities for profit in a declining market. Mastering the recognition of downward trends involves comprehensive market analysis and employing various analytical tools to make informed decisions. By successfully identifying and trading in alignment with downward trends, traders can improve their outcomes and navigate the challenges of the Forex market with greater proficiency.