Long and short positions

Trading in the Forex market offers traders the unique opportunity to profit from both rising and falling currency pair prices. To capitalize on these price movements, traders can take long (buy) and short (sell) positions.

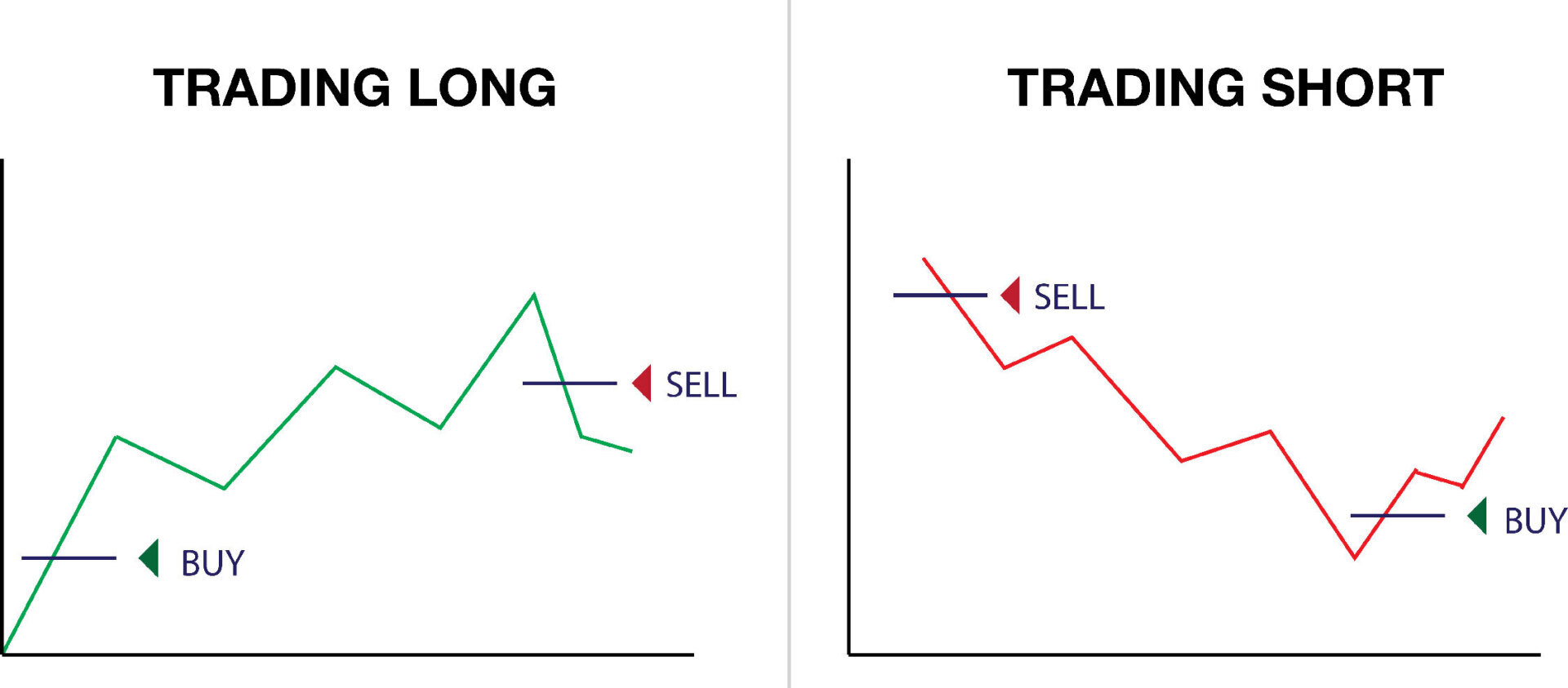

A long position involves purchasing a currency pair with the intent of selling it later at a higher price. When a trader opens a long position, they anticipate that the price of the currency pair will increase, allowing them to realize a profit.

Traders typically enter long positions when they expect the base currency to strengthen against the quote currency. Employing both technical and fundamental analysis, along with market news and economic indicators, can help identify the right moments to enter long trades.

One of the primary risks associated with taking a long position is that the price of the currency pair may decline instead of rising as anticipated. To mitigate this risk, traders often set stop-loss orders, which automatically close a position if the price reaches a predetermined level, helping to limit potential losses.

Conversely, a short position involves selling currency pairs with the goal of buying them back at a lower price. When a trader opens a short position, they expect that the price of the currency pair will decrease, allowing them to profit from the difference.

Traders typically choose to short a currency pair when they anticipate that the base currency will weaken relative to the quote currency. Similar to long positions, technical and fundamental analyses, as well as economic trends and news, are used to inform decisions on when to sell.

The primary risk when opening a short position is that the price of the currency pair may rise instead of falling, which could lead to losses. Again, stop-loss orders are essential in these scenarios to help manage risk effectively.

It’s vital for traders to consistently use stop-loss orders and never risk more than 1-2% of their trading capital on a single trade. This disciplined approach protects their capital and helps prevent substantial losses.

Long and short positions are fundamental concepts in trading that enable traders to profit from both market upswings and downturns. Understanding when and how to open these positions is a key skill for successful trading. By leveraging technical and fundamental analysis and setting protective orders, traders can make informed decisions while minimizing risks.

In conclusion, the ability to navigate both long and short positions equips traders with the tools necessary for operating effectively in a dynamic Forex landscape. As traders enhance their skills and knowledge, they can better exploit market movements and achieve their financial goals. With diligent planning, risk management, and continuous education, anyone can succeed in the Forex market and maximize their trading potential.