New Forex indicators

The Forex market is continually evolving, and one of the key aspects of this growth is the emergence of new indicators that assist traders in analyzing market trends and making informed decisions.

Heiken Ashi Smoothed is a modified version of the classic candlestick indicator. It presents a smoother view of price data, making it easier to identify trends and changes in market dynamics. Unlike traditional indicators, Heiken Ashi Smoothed takes both price information and trading volumes into account, enhancing its accuracy for identifying trend strength and potential reversal points.

Another notable tool is the Ichimoku Kinko Hyo Cloud, which, although not entirely new, has recently gained significant popularity among Forex traders. This graphical tool consists of several components, including the cloud, signal line, and lagging line. It provides a comprehensive view of market direction and strength, as well as support and resistance levels, helping traders pinpoint potential entry and exit points.

The Bollinger Bandwidth indicator represents a novel approach to the classic Bollinger Bands. Instead of merely displaying price ranges around a moving average, this indicator measures the width of the bands in percentage terms. This provides insights into market volatility and helps traders identify periods of high or low volatility, which can inform their trading decisions.

VWAP (Volume Weighted Average Price) is another crucial indicator that displays the average price of an asset over a specified period, taking trading volume into consideration. It helps traders understand where the majority of transactions have occurred and can be instrumental in identifying price levels that may attract significant market attention.

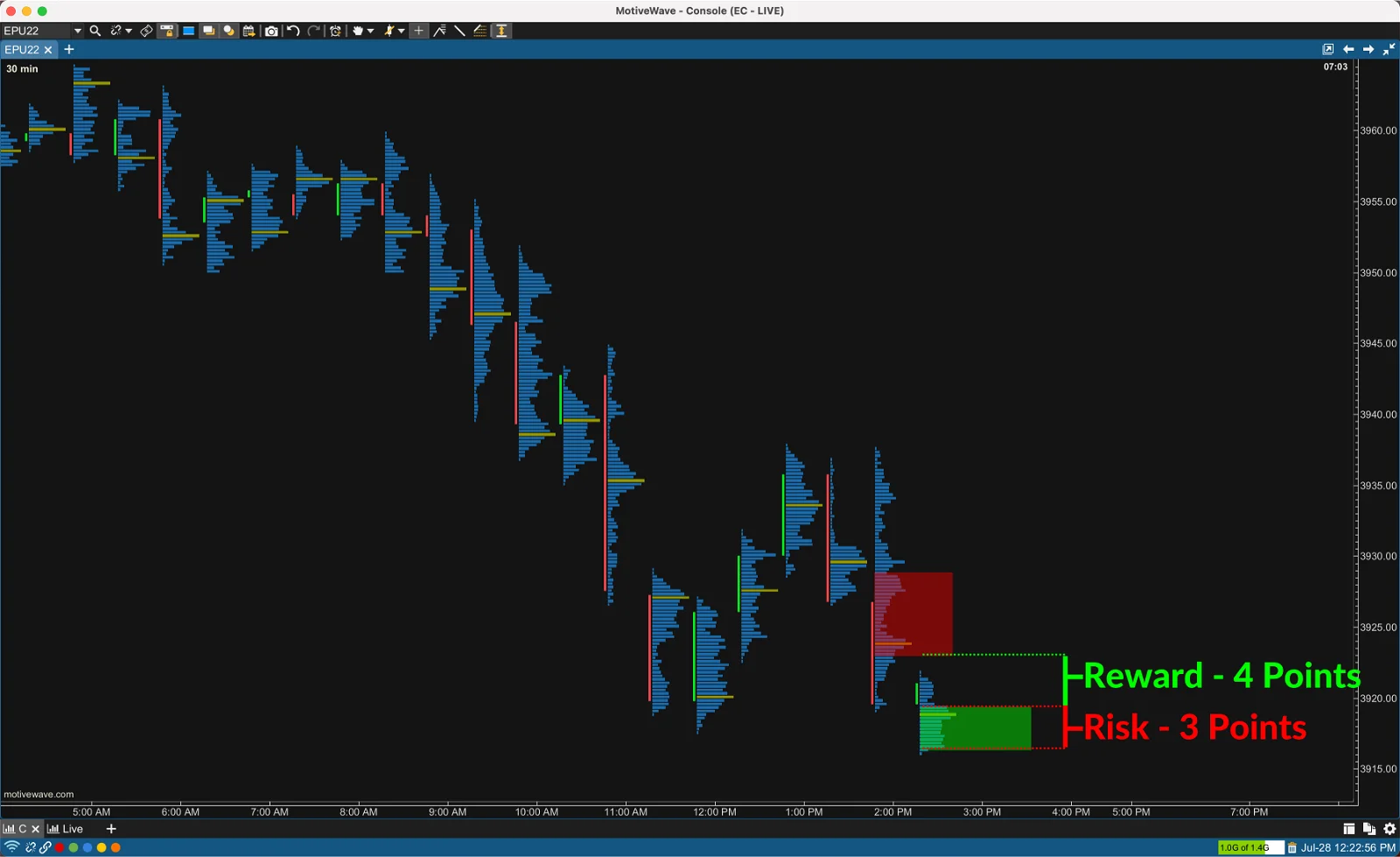

The Market Profile indicator offers a unique perspective on market structure by displaying vertical volume distributions over time. This allows traders to analyze where most trading activity occurs and which price levels hold the most significance for market participants. This analysis is valuable for identifying key support and resistance zones and determining optimal entry and exit points.

These new Forex indicators provide traders with a broader toolkit for market analysis and decision-making. However, it’s essential to remember that successful trading involves more than just using indicators; it requires a deep understanding of the market, continuous learning, and consistent practice. Traders are encouraged to experiment with different indicators and adapt them to their personal trading styles to achieve the best results.

In summary, as the Forex market continues to develop, the introduction of innovative indicators enhances traders’ ability to evaluate market conditions and make strategic decisions. By incorporating tools like Heiken Ashi Smoothed, Ichimoku Cloud, Bollinger Bandwidth, VWAP, and Market Profile into their trading arsenal, traders can gain valuable insights and improve their trading effectiveness. Ultimately, the combination of these advanced indicators with solid market knowledge and experience will pave the way for successful trading outcomes in the dynamic world of Forex.