Overbought and oversold in Forex

Overbought and oversold conditions are critical concepts in technical analysis that help traders determine the likelihood of a currency pair reversing its trend. These market states serve as signals for potential trend changes and can significantly influence trading decisions.

Overbought conditions occur when there is a substantial rise in the price of a currency pair over a short period. This situation may indicate an impending reversal or correction, as traders begin to take profits. Indicators of overbought conditions suggest that the asset has become too expensive, and the probability of a price decline increases.

In contrast, oversold conditions arise when there is a significant drop in price over a brief period. This situation can also signal a possible upward reversal or correction, as market participants may start to buy the asset at lower prices. Signs of oversold conditions indicate that the asset is undervalued, increasing the likelihood of a price increase.

One of the most popular strategies in trading is to capitalize on these reversals. When indicators signal overbought conditions, traders may see an opportunity to open short positions in anticipation of a price decline. Conversely, when conditions indicate oversold status, traders might initiate long positions expecting a price increase.

To enhance the accuracy of their signals, traders often employ additional indicators or patterns for confirmation. For instance, combining the Relative Strength Index (RSI) with support and resistance levels, along with analyzing candlestick patterns, can provide stronger evidence of a potential reversal.

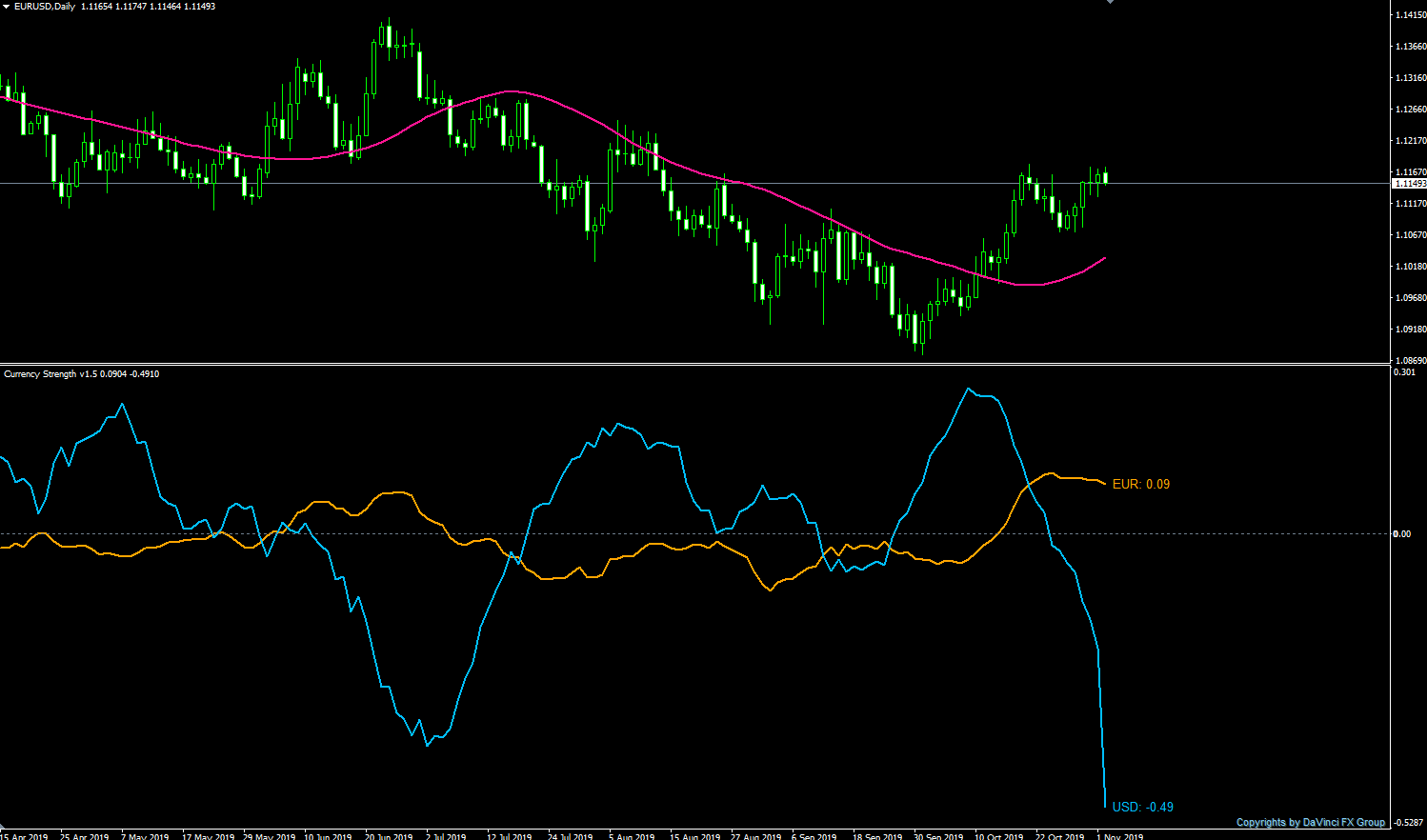

Divergence between price action and oscillators (such as RSI or the Stochastic Oscillator) can also serve as a powerful entry signal. This occurs when the price hits a new high or low, but the indicator fails to confirm the movement, hinting at a weakening trend.

Moreover, overbought and oversold conditions can be effectively integrated into trend-following strategies. In trending markets, indicators can help identify optimal entry points in the direction of the main trend following brief corrections.

In summary, recognizing overbought and oversold conditions is essential for successful trading in the Forex market. By understanding these concepts and employing them in conjunction with other analytical tools, traders can make more informed decisions, manage risks effectively, and enhance their overall trading performance. Continuous practice and a solid grasp of technical analysis will empower traders to navigate market fluctuations confidently and strategically. With the right approach, identifying these key conditions can lead to profitable trading opportunities and improved outcomes in the fast-paced world of Forex.