Profitable Forex indicators without redrawing

Finding reliable indicators for trading in the Forex market is a critical aspect for many traders. One of the key criteria when selecting an indicator is its reliability, particularly in the context of avoiding repainting.

Repainting occurs when an indicator alters its recorded values in retrospect based on new data, which can distort historical data and create misleading signals. This phenomenon can lead to incorrect data interpretation, diminishing the trader’s trust in the indicator.

Indicators that do not repaint provide more accurate and dependable signals since they maintain their values even after new data becomes available. Traders can confidently rely on historical data from these indicators for market analysis and trading decisions, assured of their reliability and accuracy.

Using reliable indicators can alleviate the stress and uncertainty associated with fluctuating indicator values over time. Here are some non-repainting indicators that traders find valuable:

- ZigZag: This indicator is effective for identifying major trends and levels of support and resistance in the market. Since it doesn’t repaint, it serves as a practical tool for determining entry and exit points in trading.

- Ichimoku Kinko Hyo: Ichimoku provides a comprehensive overview of the market’s current state, including trend direction, support and resistance levels, and potential entry points for trades. It does not repaint, making it a useful tool for traders, including scalpers.

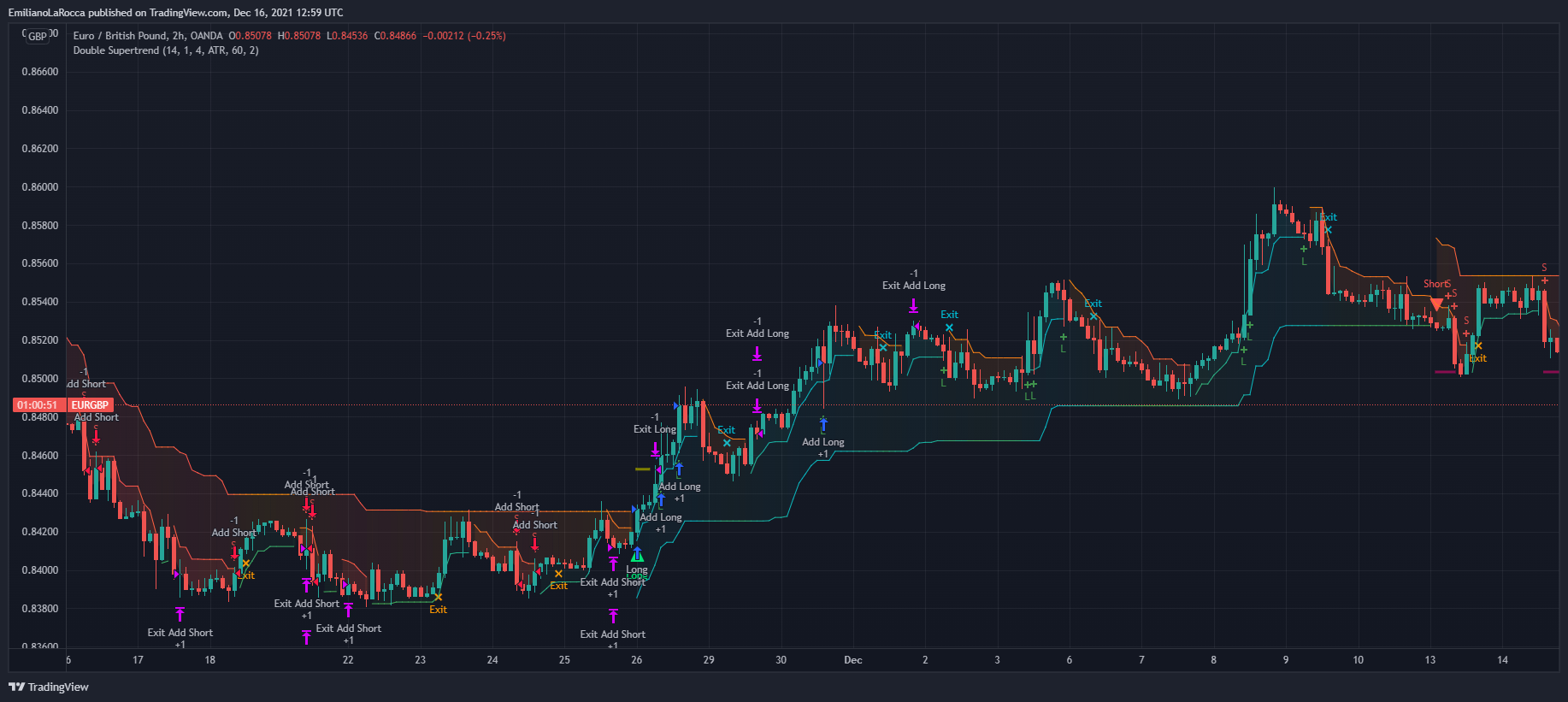

- SuperTrend: This indicator indicates the direction of the current trend and can assist traders in pinpointing entry and exit points. It is also a reliable non-repainting tool, effective in a scalping environment within the Forex market.

- Relative Strength Index (RSI): This oscillating indicator helps determine whether the market is overbought or oversold. It does not repaint and is useful for spotting reversal points and identifying favorable entry opportunities.

- Bollinger Bands: These bands represent dynamic levels of support and resistance derived from the price’s standard deviation from its moving average. As a non-repainting indicator, they are effective for assessing market volatility and identifying potential entry points.

Selecting profitable Forex indicators that do not repaint is a vital step for traders aiming for success in the currency market. Employing such indicators ensures reliable signals, eliminates data distortion, and enhances the likelihood of successful trading outcomes.

It’s important to remember that the effectiveness of any indicator is contingent upon its proper application and integration with other analytical tools. By combining these indicators with sound trading strategies and robust risk management practices, traders can strengthen their approach and improve their performance in the fast-paced Forex market. Ultimately, the key to successful trading lies not only in the indicators used but also in the trader’s ability to interpret and respond to the signals they provide.