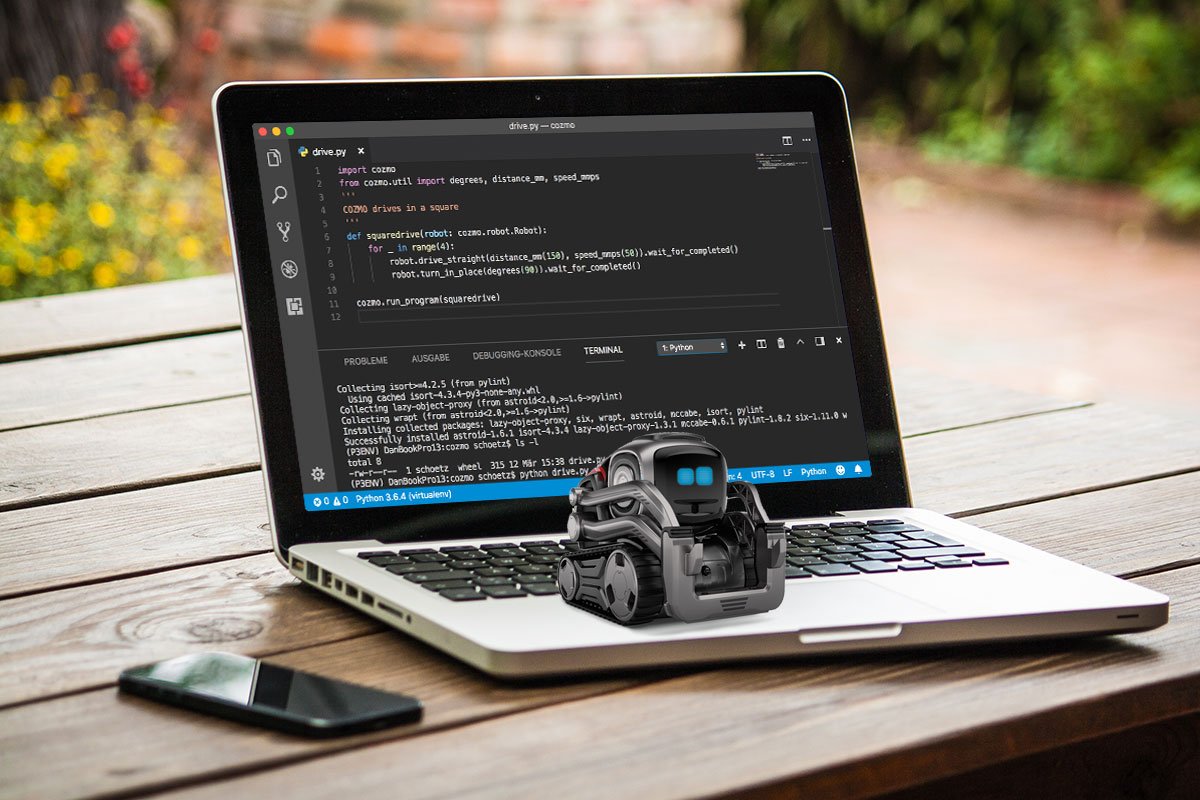

Robot for trading in python

Cryptocurrency trading is a popular arena where automation plays a key role. Using a trading bot written in Python opens up a world of possibilities for traders, from market analysis algorithms to executing trades in real-time. Python is an ideal choice for this task due to its simple syntax, extensive libraries, and powerful data manipulation tools.

Many cryptocurrency exchanges, including Binance, offer APIs for automating trading. With libraries like ccxt or binance-python, you can easily connect to the exchange and execute trades.

Python allows for the integration of machine learning libraries, such as Scikit-learn, TensorFlow, or PyTorch, to enhance trading strategies through predictive analysis of market movements.

The bot operates without human intervention, executing transactions according to a predetermined algorithm. This enables the trader to focus on strategy development instead of manual execution.

Automated trading eliminates emotional decisions, such as panic selling or fear of missing out on profits. The bot strictly adheres to pre-set rules.

The bot automates routine tasks, such as price monitoring, data collection, and chart analysis. This frees the trader from the need to constantly oversee the market.

Using Python and libraries like ccxt, traders can connect to not only Binance but also other popular exchanges, such as Coinbase, Kraken, KuCoin, and more.

To work with these exchanges, you’ll need to connect to their APIs. Basic knowledge of API keys and permission settings (like disabling legal compliance features for enhanced security) is required.

The bot allows you to test strategies using historical data before deploying them in real conditions. This helps assess their effectiveness and minimize risks. For instance, you can download trading data from Binance and analyze how the strategy performed during previous periods.

A key feature of the bot is its capability for risk management. It can automatically set stop-losses, take-profits, and limit position sizes according to risk management rules.

Python bots can keep logs of all operations, including executed transactions, errors, and balance status. This aids in analyzing the effectiveness of strategies and quickly addressing any shortcomings.

A cryptocurrency trading bot in Python is a powerful tool for automating trading processes. It helps reduce time, manage emotional factors, and respond swiftly to market changes. However, it’s essential to remember that the success of a bot depends on the soundness of the strategy and regular analysis of results. Begin testing on small or demo accounts, and you’ll soon find the bot to be an effective assistant in achieving your trading goals.