Rollback depth. Trend wave length and speed

The Forex market is characterized by constant price fluctuations, which can manifest as trends or corrections. For successful trading, it is crucial to understand the concepts of retracement depth, trend wave length, and trend wave velocity. These parameters assist traders in forecasting market behavior and making informed decisions.

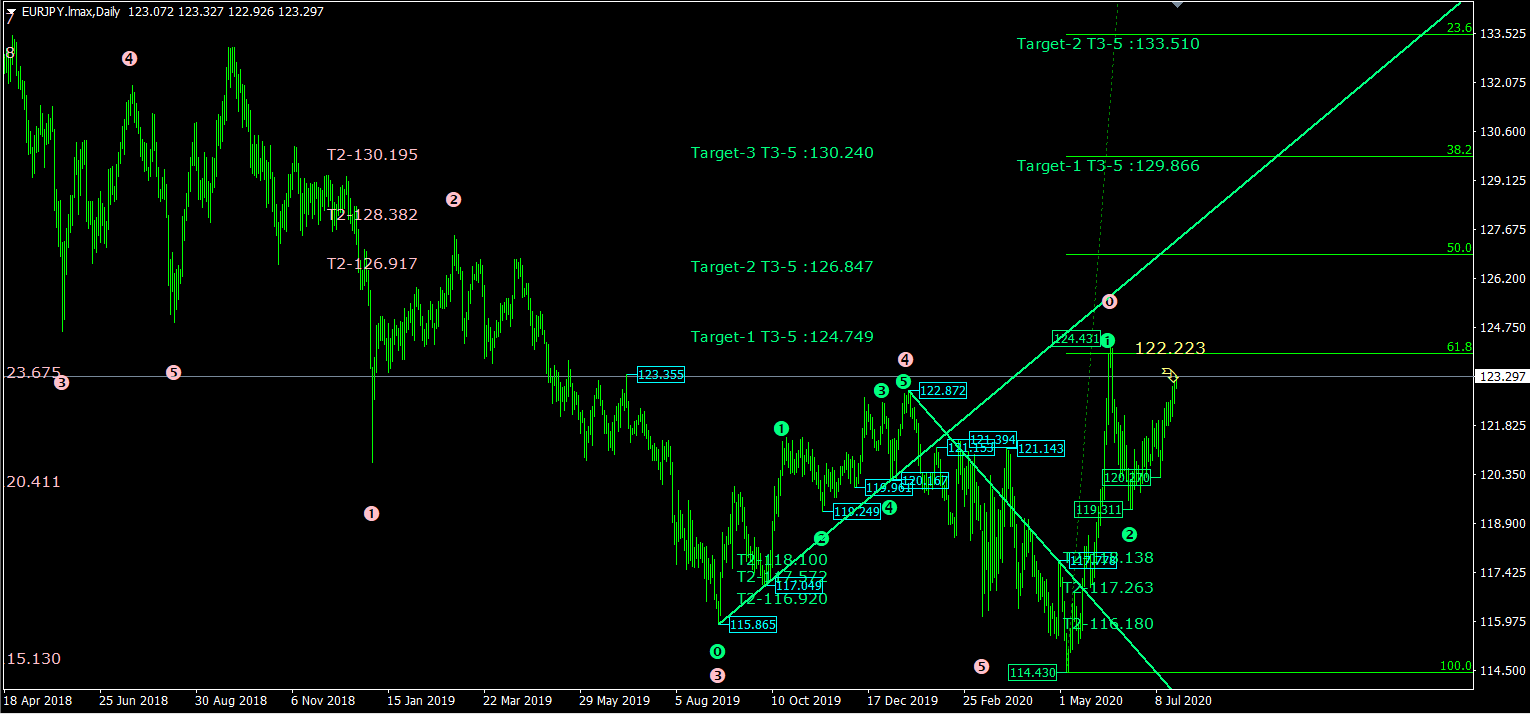

Retracement depth measures how much the price corrects in the opposite direction following a significant movement within a trend. Retracements occur when prices temporarily move against the main trend before resuming their original direction. Understanding these pullbacks can provide vital insights into potential entry points.

Trend wave length refers to the distance the price travels during a single trend movement. Longer trend waves typically indicate a strong trend, while shorter waves may suggest trend weakness or an impending reversal. Traders can utilize graphical analysis tools, such as trend lines and channels, to measure the length of these waves accurately.

The velocity of a trend wave reflects how quickly prices move in the direction of the trend. A rapid movement may indicate strong momentum, whereas a slower pace can suggest a weakening trend or potential reversal.

In robust trends, minor retracements are often accompanied by long trend waves moving at high speeds. This pattern signals strong momentum and trend resilience. Conversely, in weak trends, traders might observe deeper retracements, shorter waves, and slower price movements. These signs can indicate a possible end to the prevailing trend or a shift in market direction.

Transition phases, such as the beginning or end of a trend, can be marked by changes in retracement depth, wave length, and velocity. During these periods, traders should exercise heightened awareness and look for confirming signals to guide their decisions.

Analyzing trend waves across different time frames can provide a comprehensive understanding of market behavior. Shorter time frames, like hourly charts, can offer detailed insights into retracement depths and velocities, while longer time frames, such as daily and weekly charts, reveal the overall trend direction.

By examining historical data, utilizing technical indicators, and keeping abreast of economic news, market participants can devise strategies that incorporate these parameters. This informed approach empowers traders to make well-grounded decisions and increases the likelihood of achieving success in the dynamic Forex market.

In conclusion, a thorough understanding of retracement depth, trend wave length, and velocity is essential for any trader looking to navigate the complexities of Forex. By employing a comprehensive analytical framework that includes these elements, traders can enhance their ability to respond to market movements and optimize their trading strategies. Ultimately, continuous learning and adaptation to market conditions will lead to improved trading outcomes and a deeper understanding of the ever-evolving Forex landscape.