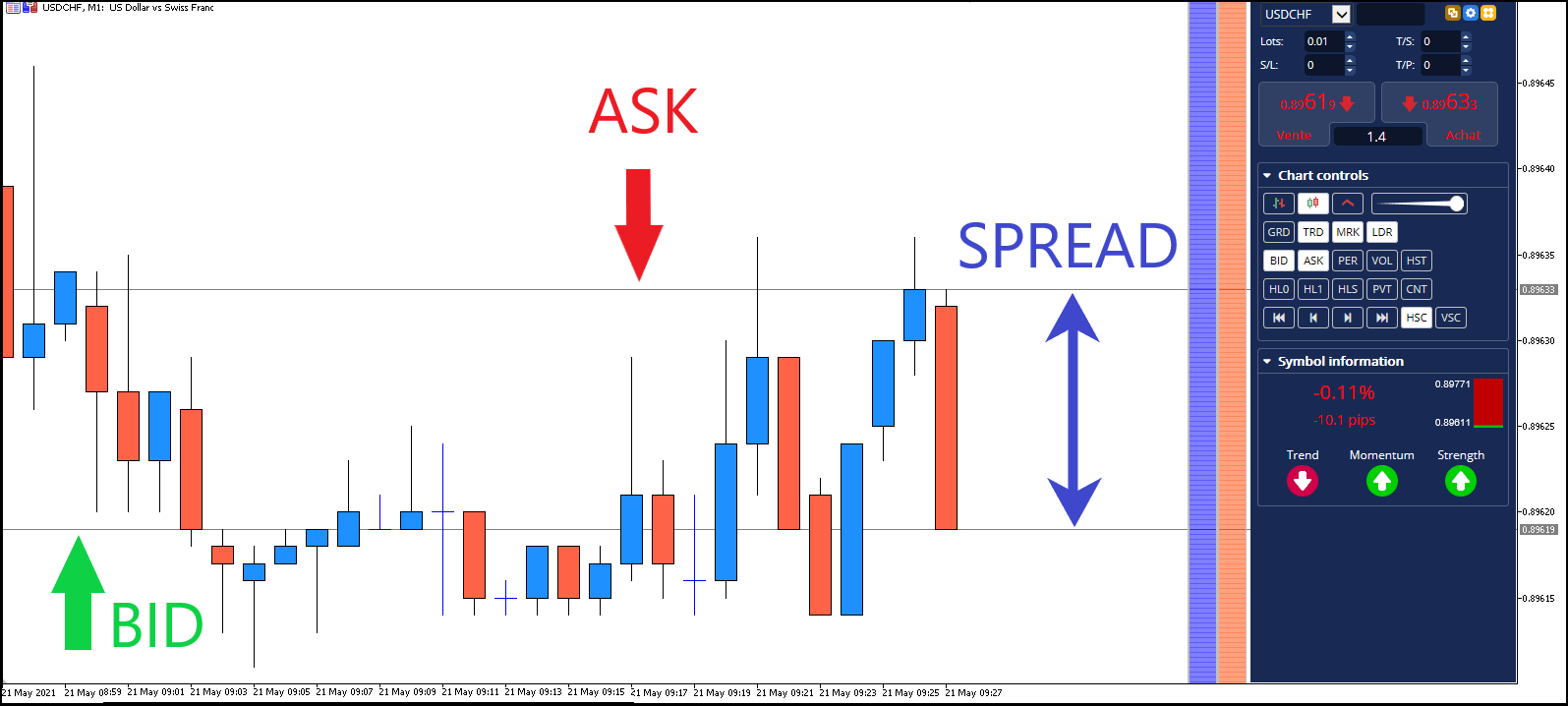

What is a spread?

The spread is one of the fundamental concepts in Forex trading, playing a crucial role in determining the cost of trading and impacting a trader’s profitability.

Essentially, the spread represents the broker’s earnings from executing trades, functioning as a cost to the trader. A fixed spread remains unaffected by market conditions. Brokers set a constant value that doesn’t change based on the time of day or market volatility. This consistency provides traders with confidence, knowing they will pay the same spread for each transaction, which simplifies the planning of trading strategies.

On the other hand, a floating spread (or variable spread) fluctuates with market volatility and liquidity. During stable market conditions, these spreads can be quite narrow, but during periods of increased volatility, they can widen significantly. Floating spreads often offer more competitive conditions during stable times, but they may become more expensive in volatile environments.

The spread constitutes a significant part of trading costs. A wider spread results in higher expenses associated with opening and closing positions. For scalpers, who conduct numerous trades throughout the day, selecting brokers with tighter spreads is essential to minimize costs.

Narrow spreads generally indicate a high liquidity in the currency pair, meaning there is a larger number of market participants and more stable price movements. In contrast, currency pairs with low liquidity often exhibit wider spreads, which can make trading more expensive.

Understanding the spread is imperative for anyone involved in Forex trading, as it directly affects the cost of transactions and overall trader profitability. Knowing what a spread is, how it is calculated, and the different types available helps traders make more informed decisions and select the most advantageous trading conditions.

In summary, the spread is a crucial aspect of Forex trading that can significantly influence a trader’s costs and profits. By grasping the dynamics of spreads, traders can optimize their strategies, reduce trading expenses, and improve their financial outcomes in the market. As you develop your trading approach, consider the implications of spreads and choose a broker that aligns with your trading goals for optimal success.