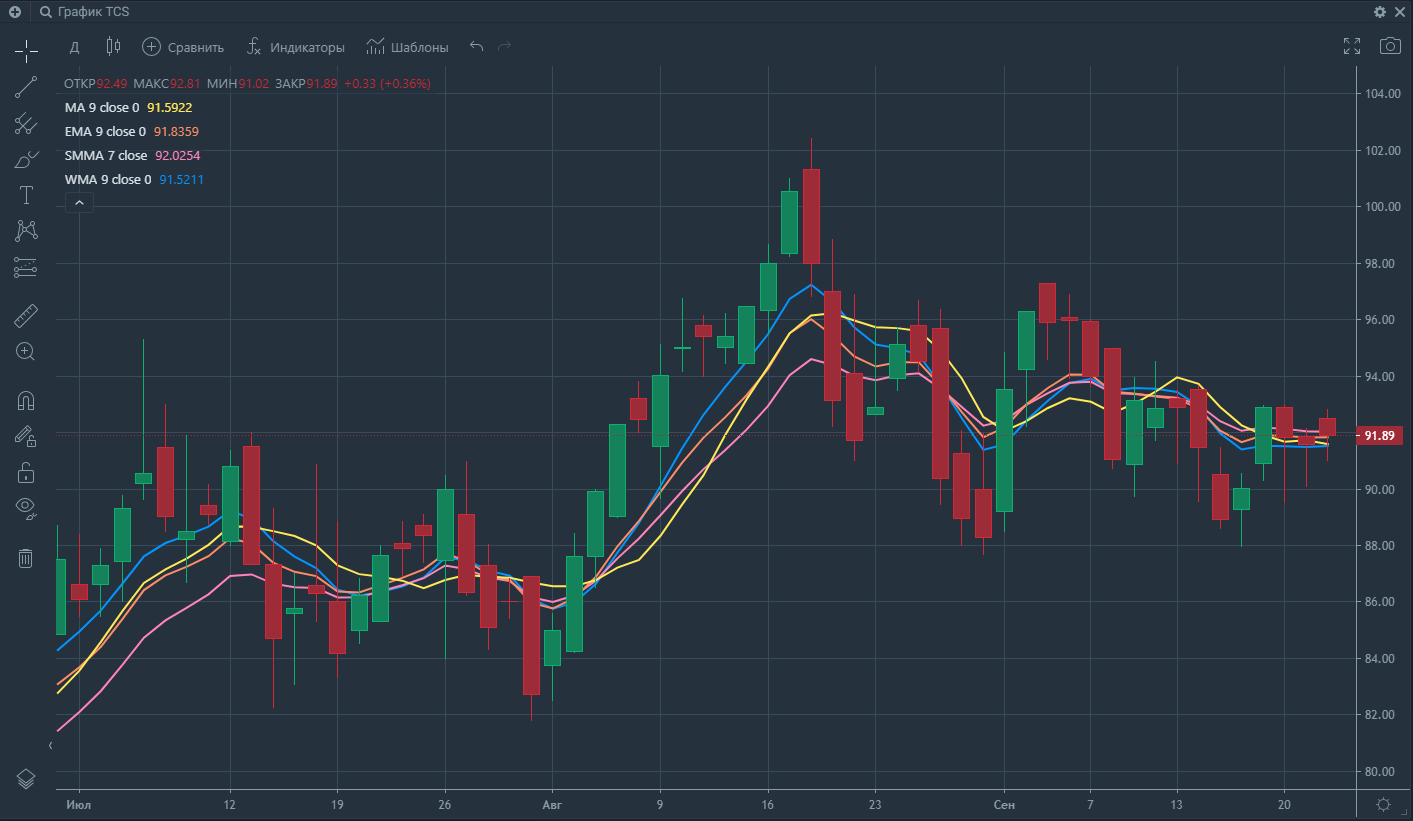

What the chart of technical indicators shows

Technical indicators on the Forex market are essential tools for analysis, aiding traders in making informed decisions about buying and selling currency pairs. These indicators play a crucial role in forecasting future price movements based on historical data and current market conditions.

At the heart of these indicators are mathematical calculations applied to various market parameters, such as price and volume. These calculations help identify trends and potential entry and exit points for trades. Typically, this information is visualized through charts and graphs on trading platforms, allowing traders to assess market conditions at a glance.

Interpreting these indicators requires a solid understanding of their nature and the context in which they operate within the current market. For instance, when the Relative Strength Index (RSI) exceeds seventy, it may indicate that an asset is overbought, which could suggest a potential price reversal. Conversely, an RSI reading below thirty could point to an oversold condition, indicating a possible upward correction.

It is important to recognize that while technical indicators provide valuable insights, they do not guarantee outcomes. They serve as tools to improve the likelihood of profitable trades rather than certainties of profit. Experienced traders often employ a combination of different indicators to gain a more comprehensive view of market dynamics and mitigate risks effectively.

Moreover, technical indicators empower traders to analyze trends, determine levels of overbought and oversold conditions, and evaluate both volume and volatility. When used judiciously, these tools can significantly enhance the potential for successful trading outcomes. For optimal results, they should be integrated with fundamental analysis and sound risk management strategies.

Ultimately, the disciplined application of technical indicators, alongside an understanding of market fundamentals, can increase the odds of achieving favorable trading results. As trends evolve and market sentiments shift, the ability to interpret these indicators accurately becomes invaluable for any trader seeking to navigate the complexities of the Forex market. By blending both technical and fundamental insights, traders can develop more robust trading strategies that adapt to changing market conditions, ensuring they are well-prepared to capitalize on emerging opportunities. This multifaceted approach not only aids in making informed trading decisions but also bolsters traders’ confidence in their actions, facilitating a more systematic and analytical approach to trading in the dynamic Forex landscape.