Working Forex indicators

In the Forex market, every trader aims to develop an effective strategy that enables them to make informed decisions and achieve desired results. One of the essential tools for market analysis and decision-making is the use of reliable indicators.

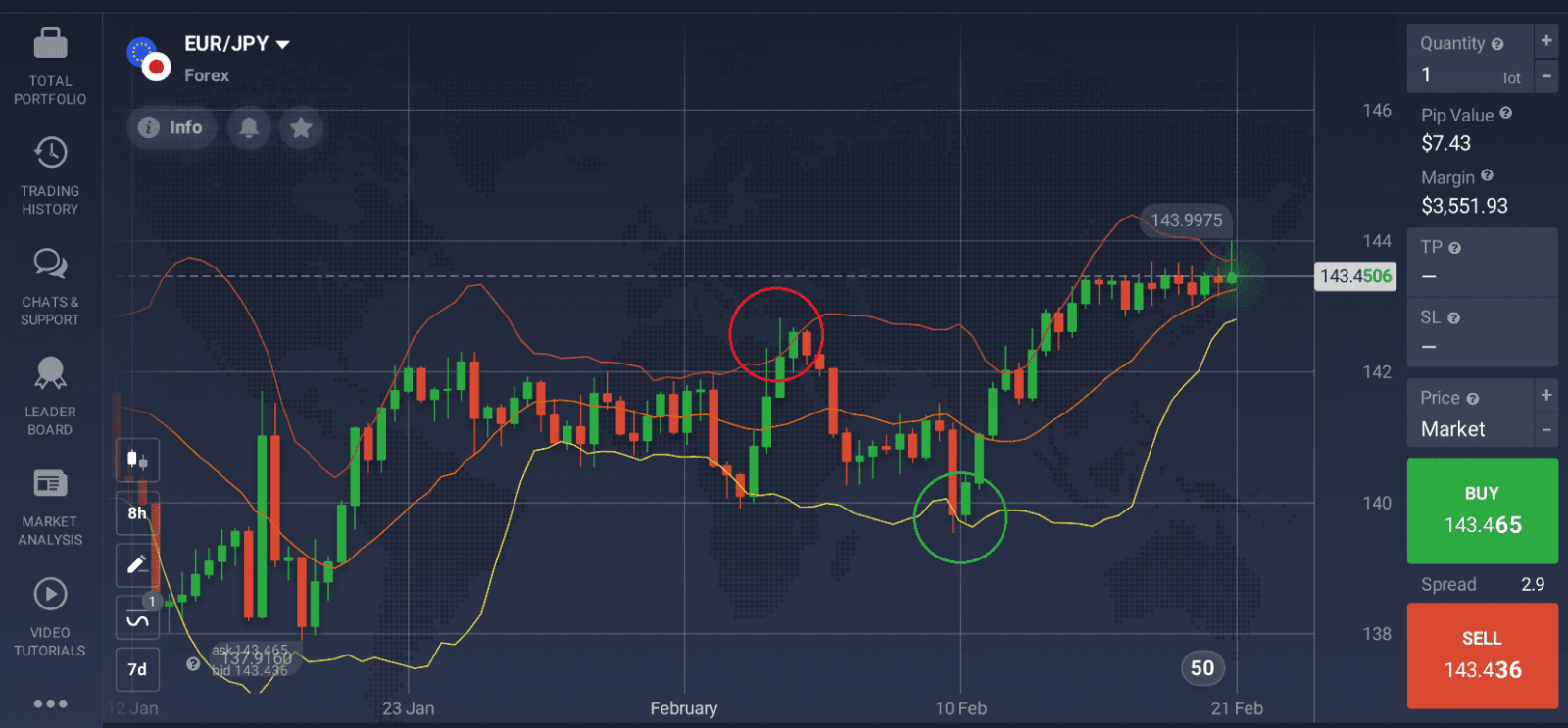

A key aspect of successful trading is accurately identifying the current trend. Various indicators, such as moving averages and stochastic oscillators, assist traders in determining the direction of price movements. Understanding whether a currency pair is trending upward, downward, or sideways is critical for formulating trading strategies.

Reliable indicators also help traders pinpoint crucial support and resistance levels on price charts, guiding decisions about when to enter or exit trades. Recognizing these levels can provide valuable insights into potential reversal points or breakout opportunities.

One effective approach involves combining different indicators to generate clearer and more accurate signals. For instance, pairing moving averages with the Relative Strength Index (RSI) can help confirm entry or exit signals, thereby enhancing decision-making accuracy. Regardless of the chosen strategy, always maintaining robust risk management practices, including setting stop-loss orders, is essential to safeguard against potential losses.

With a plethora of indicators available, selecting the right one for a specific trading strategy can be challenging. Many traders often experiment with various indicators to discover which ones best suit their trading style and objectives. This process can involve backtesting indicators on historical data or practicing with them on demo accounts before committing real capital.

To use these indicators effectively, traders must possess a solid understanding of how they operate. Additionally, having enough experience to correctly interpret the signals they generate is crucial. This interpretation allows traders to react appropriately to market conditions and make decisions that align with their overall trading strategy.

Despite potential limitations, Forex indicators remain an important asset for many traders and can significantly enhance their trading performance. It’s important to remember that successful trading requires not only the ability to use indicators but also a thorough analysis of both the fundamental and technical aspects of the market, along with effective risk management strategies.

In conclusion, the integration of reliable indicators into trading systems provides valuable insights that can lead to more informed decision-making in the dynamic Forex market. By continually refining their strategies, staying informed about market developments, and embracing a methodical approach to trading, traders can enhance their chances of success. Ultimately, developing a comprehensive trading plan that combines effective indicators with sound analysis will empower traders to navigate the complexities of the Forex market with confidence and achieve their financial goals.